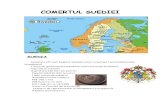

comertul extern

Transcript of comertul extern

-

7/26/2019 comertul extern

1/115

Avantajele competitive ale Romnieipe piaa interna UE

STUDII DE STRATEGIE I POLITICI 2013 - nr. 1 STRATEGY AND POLICY STUDIES 2013 no. 1

-

7/26/2019 comertul extern

2/115

INSTITUTUL EUROPEAN DIN ROMNIA

STUDII DE STRATEGIE I POLITICI SPOS 2013Studiul nr. 4

AVANTAJELE COMPETITIVE ALE ROMNIEIPE PIAA INTERNA UE

Autori:

Geomina URLEA (Coordonator)Valentin COJANUAlina ALEXOAEI

Georgiana NECULAURadu PETRARIU

Bucureti, 2014

-

7/26/2019 comertul extern

3/115

Coordonator de proiect din partea Institutului European din RomniaAgnes Nicolescu

Institutul European din Romnia, 2014ISBN online 978-606-8202-41-9Bd. Regina Elisabeta nr. 7-9Sector 3, BucuretiE-mail: [email protected]: www.ier.roGrafici DTP: Monica DumitrescuFoto copert: http://www.sxc.hu/

Studiul exprimopinia autorilor i nu reprezintpoziia Institutului European din Romnia.

mailto:[email protected]://www.ier.ro/http://www.sxc.hu/http://www.sxc.hu/http://www.sxc.hu/http://www.ier.ro/mailto:[email protected] -

7/26/2019 comertul extern

4/115

CUVNT NAINTE

Promovarea unor politici publice riguros fundamentate, sprijinite pe analize i dezbateri prealabile,reprezint un element esenial n furnizarea unor rezultate de calitate i cu impact pozitiv asupra vieii

cetenilor. Institutul European din Romnia, n calitate de instituie public cu atribuii n sprijinireaformulrii i aplicrii politicilor Guvernului, a continuat i n anul 2013 programul de cercetare-dezvoltarededicat Studiilor de strategie i politici (Strategy and Policy Studies SPOS).

Programul SPOS este menit a sprijini fundamentarea i punerea n aplicare a politicilor GuvernuluiRomniei n domeniul afacerilor europene, oferind decidenilor politici informaii, analize i opiuni depolitici.

n anul 2013, n cadrul acestui proiect au fost realizate patru studii, care au abordat arii tematicerelevante pentru evoluia Romniei n context european. Cercetrile au urmrit furnizarea unor elemente defundamentare i a unor propuneri de msuri n domenii cheie precum piaa de energie electric i gaz(Liberalizarea treptat a pieelor de energie electrici gaz i impactul acestui proces asupra economieiromne

ti), politica de incluziune (Politici de incluziune a romilor n statele membre ale UE), libera

circulaie a lucrtorilor (Estimarea impactului liberei circulaii a lucrtorilor romni pe teritoriul UE,ncepnd cu 01.01.2014; realiti i tendine din perspectiv economic, ocupaionali social, la nivelnaional i european) i competitivitatea pe piaa unic (Avantajele competitive ale Romniei pe piaainternUE).

Studiul de fa, Avantajele competitive aleRomnieipe piaa internUE, a beneficiat de contribuiileunei valoroase echipe de cercettori formate din:

Geomina urlea, economist cu 20 de ani de experien n cercetare aplicat de profil, n special nelaborarea de studii i analize pentru fundamentarea deciziilor politice. A absolvit cursurile Academiei deStudii Economice, Bucureti, Facultatea de Cibernetic, Statistici InformaticEconomic, promoia 1994, ideine titlul de Doctor n Economie acordat de Academia Romnn anul 2004. De la absolvire pna n anul2005 a ocupat diferite poziii de cercetare n cadrul Institutului de Economie Mondial, Bucureti, Romniadupa care, pnn anul 2013 i-a continuat activitatea profesionalca i cercetator n cadrul Centrului Comunde Cercetare al Comisiei Europene, Institutul de Studii Tehnologice Prospective, Sevilia, Spania. Este autorsau coautor a peste 40 de articole tiinifice publicate n reviste indexate i volume de specialitate i acontribuit la numeroase rapoarte de cercetare i documente de politiceconomic. Principalele sale domenii deexpertiz sunt analiza cantitativ a competitivitii i rolul cercetrii n tehnologiile de informaie icomunicaie n procesul de integrare economiceuropean.

Valentin Cojanu, profesor n domeniul economiei internaionale la Academia de Studii Economice dinBucureti i editeazrevista de studii interdisciplinareJournal of Philosophical Economics. A publicatLogicaraionamentului economic (C.H. Beck, 2010) iIntegrare i competitivitate. Modele de dezvoltare economicn Europa de Sud-Est (Ed. ASE Bucureti, 2007) (n coordonare). Interesul de cercetare se orienteaz ctre

economie teritorial i dezvoltare economic, formarea avantajelor competitive n competiia internaional,precum i ctre re-orientarea economiei ca tiinsocial.

Alina Alexoaei (Negrea) - doctorand n cadrul ASE Bucureti, domeniul Economie i AfaceriInternaionale. Domenii de cercetare: comer internaional, comer i inovare, competitivitate regional isectorial. Membru n echipa de cercetare n cadrul proiectului Analiza stadiului competitivitii i inovrii nregiunea Sud Muntenia, 2012. Publicaii recente: Negrea Alina Petronela (2012) - Regional Competitiveness:Introducing Clusters and Innovation Systems. Case Study: Sud Muntenia Region, Constana, Annals ofOvidius University of Constanta, Seria: tiine Economice - Vol. XII, Nr.2/2012 pp. 289-294, ISSN 1582-9383; Negrea Alina Petronela (2012) - What about structural convergence?, Brasov, volumul conferinei

-

7/26/2019 comertul extern

5/115

Business Excelence Challenges During the Economic Crisis, Vol II, Ed. Universitii Transilvania, 2012, pp.35-39, ISSN, ISBN 978-606-19-0102-9; Negrea Alina Petronela, Cojanu Valentin (2013) Where do wereally stand? Romanias performance in terms of unit values and market share , Sibiu, Proceedings ofInternational Economic Conference of Sibiu - IECS 2013, pp. 599-607, ISSN 2344-1682

Georgiana Neculau este cercettor, coordonator de programe n cadrul Centrului Romn pentruModelare Economic(CERME). Activitatea de cercetare include, ncepnd cu aria tematica managementuluistrategic n dezvoltarea social, incluziunea social, analiza grupurilor vulnerabile, monitorizare i evaluare

dar i cercetare-dezvoltare i competitivitatea companiilor. n ultimii ase ani a participat, n calitate decercettor n cadrul CERME, i totodatconsultant independent, n mai multe proiecte cu finanare naionaliinternaional: Integration Strategies for Urban Poor Areas and Disadvantaged Communities(World Bank),Knowledge Mapping Project(World Bank),Helping the Invisible Children(UNICEF),Real Time Monitoringfor the Most Vulnerable(Institute of Development Studies, Brighton, UK), The performance of public healthcare system in South-Eastern Europe (Friedrich Ebert Foundation Belgrad), Analysis of the correlationbetween the research-development expenditure and the economic performance of the main companies inRomania ROSCORD (Financed by PNCDI II/ PROGRAM 4), Multidimensional diagnosis of childssituation in Romania(UNICEF),Rapid Assessment of the Social and Poverty Impacts of the Economic Crisisin Romania (UNICEF), Strengthening the civil society capacity of promoting social inclusion initiatives (ANBCC), etc.

Ioan-Radu Petrariu este doctorand n cadrul colii doctorale Economie i afaceri internaionale aAcademiei de Studii Economice din Bucureti. De-a lungul timpului a avut un rol proactiv n cadrulcomunitii universitare fiind n prezent cadru didactic asociat al Facultii de Relaii EconomiceInternaionale. Printre domeniile sale specifice de interes, cercetare i specializare se numr: competitivitateaeconomic, comerul internaional i politicile comerciale, strategiile de export, politicile europene, cretereaeconomic, dezvoltarea durabil, inovarea, publicnd n calitate de autor sau coautor articole tiinifice ndiverse reviste de specialitate. Pentru ct mai clara prezentare i interpretare a proceselor i fenomenelorutilizeazatt perspectiva microeconomicct i cea sectoriali macroeconomic.

Pe parcursul realizrii studiului, echipa de cercettori s-a bucurat de contribuia activ a lui AgnesNicolescu n calitate de coordonator de proiect din partea IER, precum i de sprijinul unui grup de lucru,alctuit din reprezentani ai principalelor instituii ale administraiei centrale cu atribuii n domeniu.

n final, adresez mulumirile mele att cercettorilor, ct i tuturor celor care au sprijinit derulareaacestei cercetri.

Gabriela DrganDirector general al Institutului European din Romnia

-

7/26/2019 comertul extern

6/115

CUPRINS

SUMMARY7

SINTEZ.15

INTRODUCERE............................................................................................................................................. 23

CAPITOLUL I. ............................................................................................................................................... 28

Competitivitatea comerului exterior al Romniei i integrarea pe piaa Uniunii Europene............................ 28

1.1 .......................................................................... 28Comerul exterior al Romniei - o privire de ansamblu

1.2 ............................................................................... 32Scurtprezentare a balanei comerciale a Romniei

1.3 ......................................................... 35Concentrarea geografica schimburilor pe piaa uniceuropean

1.4 .................................................................................................................................. 39Raportul de schimb

1.5 ........................................................................... 40Analiza exporturilor/importurilor pe grupe de produse

1.6 ......................................... 42Convergena structuraldintre comerului exterior al Romniei i cel al UE

CAPITOLUL II. .............................................................................................................................................. 46

Performana sectoarelor de export ale Romniei .............................................................................................. 46

2.1 ...................................................................................................... 46Scurtreferire la metoda de abordare

2.2 Tendine structurale recente n comerul Romniei................................................................................. 47

2.3 Dinamica avantajelor competitive ale Romniei pe principalele piee de export (2001-2011).............. 48

CAPITOLUL III. ............................................................................................................................................ 60

Competitivitatea la export i dezvoltarea economiei naionale......................................................................... 60

3.1 ................................................................. 60Tendine definitorii n globalizare i convergeneconomic

3.2 ........................................................................................................................... 64Structuri specializare

3.3 ....................................................................................................... 71Specializare pe verticali integrareCAPITOLUL IV.............................................................................................................................................. 79

Studii de caz: industria auto i industriile culturale i creative ......................................................................... 79

4.1 ........................................................................................................................................... 79Industria auto

4.2 ................................................................................................................ 82Industriile culturale i creative

CAPITOLUL V. .............................................................................................................................................. 86

Concluzii ........................................................................................................................................................... 86

5.1...................................................................................................................................... 86

Concluzii generale asupra competitivitii pe piaa UE a comerului exterior al Romniei i legtura cucreterea economic

5.2. Concluzii referitoare la produsele cheie de export ale Romniei (nivel detailat)................................... 89

BIBLIOGRAFIE ............................................................................................................................................. 92

-

7/26/2019 comertul extern

7/115

Studii de Strategie i Politici SPOS 2013

7

SUMMARY

Contribution to the literature

This study contributes to the literature on the competitiveness of Romanian exports with a newperspective over the decade 2001-2011, by overlapping of two complementary analyses: of the exportperformance dynamicsand of the domestic revenues created by export manufacturers and their suppliers.The analyzed period includes the period of global economic growth (mainly 2003-2007) and the first years ofthe economic crisis (2009-2011 ). The year 2007, when Romania joined the European Union, is in the middleof the analyzed period.

The dynamics of Romania's export performancewas assessed through a specific method combiningthree different research lines(1) changes in the ranking of exported products in the reference years 2001 and2011, (2) evolution of the performance of key products exported in 2001 and (3) the position in 2001 of keyproducts exported in 2011.

The analysis of domestic revenues created by export manufacturers and their suppliersprovides, forthe first time for Romania a brief study on the position of the country on the global value chain, following thelogic proposed by the European Commission in its last two European Competitiveness Reports (2012 and2013).

When corroborated, the results of the two analyses can be used to discuss the extent to which the currentstructure of exports contributes to the generation of domestic revenues and as such might prove useful in thedebate on the identification of a country brand for Romania. In order to achieve the latter goal, we conductedtwo detailed case studies on two reference sectors of the Romanian economy: motor vehicles and creativeindustries.

Single Market and Globalization

A fundamental dimension with impact on the analysis and its results is the status of Romanian as partof the European single market. The European Single Market plays a catalyst role in encouraging both the intra-European trade and the trade between EU member states and the rest of the world and at the same time it leadsto increasing innovation, production and efficiency growth capacity, as a result of the access to a larger marketfor the EU companies and of enhanced resources to which they have access. The integration mechanism willreflect in several quantitative dimensions which we follow, such as: convergence in per capita incomes andstructural changes (both in the structure of foreign trade and sectorial), synchronization of business cycles,evolution of intra-industry trade. We strive though to separate, as much as possible, the effects of Europeanintegration from those of globalization in general, because we believe that we can refer to a process of "two-speed globalization" in the sense that European integration precedes the globalization process, both in case ofgoods and of services.

Otherwise said, the creation of the single market and economic integration is a concerted, Pareto-optimal economic development process which insures an advantage to the Member States, when compared tothe open arena of competitive confrontation on the global market. From the perspective of this study, theabove means that the analysis of Romanias competitiveness on the EU market does not only needs to identifythose areas of the economy with performance on the EU markets, but also those which contribute, directly orindirectly, to the EUs performance on global market, since these might very likely develop further in thefuture.

-

7/26/2019 comertul extern

8/115

Avantajele competitive ale Romniei pe piaa interna UE

8

Major global trends in exports and Romanias position

The period 2001-2011 saw a substantial increase of the world market, an acceleration of exportsdynamics and important changes in their geographical structure, particularly due to the increasingly significantpresence of emerging economies on the international markets and the corresponding reduction of the share ofadvanced ones, including of the EU as a whole. EU dynamics results nevertheless from different trends for

EU151 and EU122. The share of Romania and the rest of the EU12 countries in total international tradecontinued to grow, which suggests that, similarly to the emerging economies, countries that joined the EU inthe fifth wave of European integration are still in an extensive development stage. This characteristic wasmitigated towards the end of the interval considered. On the other hand, it is noteworthy that the EU15countries export more than they import, which was also the case of EU12 countries in 2011, but this it not thecase of Romania.

The structure on large groups of export products witnessed only minor changes the globalizationprocess took place at a faster pace for manufacturing goods than for the services (the share of manufacturedgoods in the global exports increased, while the share of services declined slightly). However, what we cannotice, mainly in the case of the manufactured goods, is an increase in the share of exports, dedicated tointermediate consumption, as a consequence of the increasing fragmentation of production chains at

international level.

In this global context, the dynamics of Romanias overall position between 2001 - 2011 ischaracterized by a significant increase in the countrys share in world total exports, and practically on allmarkets. Trade links between Romania EU have developed the fastest, as a result of the economicintegration. Moreover, the level of convergence of Romanias intra- industrial trade with the EU-27 increasedsignificantly, which means that the likelihood for asymmetric shocks between Romania and the EU continuesto decrease.

Romanias export growth was accompanied however by an even more significant increase of imports,which resulted in an ever more negative foreign trade balance, both with the world economy but especiallywith the other EU countries. For this reason, access to non-EU markets must remain a priority for the trade

policy.

In 2011, the top EU countries importing Romanian goods (excluding services) were: Germany (1) Italy(2), France (3), Hungary (4), Bulgaria (5), United Kingdom (6), Netherlands (7), Spain (8), Poland (9), Austria(10). Germany is Romanias main trading partner. With minor variations, this hierarchy has remained constantthroughout the analysed period. In the year 2011, Romania had trade surplus with seven EU Member Statesand a deficit in the relationship with the other 19. France is the country with which Romania has the mostsignificant trade surplus, which reflects, to a large extent, the export performance of machinery and transportequipment.

Structural considerations on Romanian exports

From a structural point of view, the share of Romanias agricultural products in world exports doubledin the timeframe considered, (with the main increase to EU15), and important increases in exports ofindustrial goods (mainly to EU12 and EU15) as well as in exports of market services (particularly to BRIC3countries and the rest of the world.

1EU15 area countries are: Austria, Belgium, Denmark, France, Finland, Greece, Ireland, Italy, Luxemburg, Netherlands, Portugal,United Kingdom, Spain, Sweden.2EU12 area countries are: Bulgaria, Cyprus, Czech Republic, Estonia, Latvia, Lithuania, Malta, Poland, Romnia, Slovakia, Slovenia,Hungary.3Brasil, Russia, India, China

-

7/26/2019 comertul extern

9/115

Studii de Strategie i Politici SPOS 2013

9

The agricultural potential is still far from being fully exploited, as results from the negative balance oftrade in food, beverages and tobacco while the agriculture employs an important part of the labor force.Agriculture is of course situated on the value chain of the foods and beverages industry, an increasinglyimportant sector for Romania in terms of share in world and European added value but not in terms of foreigntrade. The food and beverages industry has a medium level of fragmentation, but the share of intermediateconsumption in the Romanian agricultural sector has declined significantly between 2001 and 2011. Currently,the vast majority of the agricultural production is used for direct final consumption of households. Romanianagriculture is currently supported by the Common Agricultural Policy, but in order to maintain the advantagethus created, the development of this sector will have to be based on increasing quality and sustainability ofagricultural products and on exploiting niches, through diversification and processing.

International trade in market services is also a special case. As a result of the current state ofglobalization, the share of exports in total production and value-added in market services has grown in mostmacro-regions, including EU12, but not in Romania. Considering the liberalisation of service markets in theEU and that the share of market services produced in Romania in global production and value-added grewsteadily from 2001 to 2011, it would be useful to investigate Romanias potential competitive advantage onthe international market in this field and of possible barriers to its realisation. It is important to note that,compared to other EU countries, goods produced in Romania embed the smallest share of services asintermediate consumption, which means that growing services are directed mostly to the final consumption.

As regards the manufactured goods, a particular case is the fast growth of Romanias exports of motorvehicles which have doubled over the considered timeframe. This is a consequence of the presence inRomania of major international car manufacturers, , especially Renault, which accounts for the majority shareof the Romanian exports of motor vehicles. A second main group of manufactured goods exported byRomania are other industrial goods4, which together with the motor vehicles represent almost three quarters ofthe countrys total exports of manufactured goods. The counter example is represented by the chemicalproducts, with growing trade deficit, in the context of a steep competitivity loss of the local petrochemicalindustry.

Last but not least it is worth noting that Romania exports more raw materials than imports, which shows

that the countrys position on the value chain could be improved with the existing resources. Meanwhile, thefinal consumption goods have dominated the imports structure, which created further disadvantages for theposition of the Romanian economy in the context of the recent global crisis. However, except for 2002 and2009, Romania has experienced a period of relative improvement of its economic performance andcompetitiveness of exported goods, situation reflected in terms of trade higher than one. . From thisperspective, 2004, 2005, 2006 and 2007 brought the best results and after the economic crisis began, the year2010 marked a positive trend.

Analysis of the dynamics of Romanian exports performance

The ranking of top of goods exported by Romania has changed between 2001-2011, the three mainclasses of products exported in 2011 having a small share in the previous ten years. Structural changes brought

into the top cars and the group equipment, nuclear reactors, boilers, in parallel with the exit of textiles, leatherproducts and footwear (present in 2001). In 2011, the main group of products exported by Romania waselectronic and electric equipment. There was a decrease in the share of low-technology goods in favor ofmedium technology as well as an increase in technology-intensive goods. However, from the perspective ofthe market shares, the performance of key products exported in 2001 was significantly higher than keyproducts exported in 2011.

4Various manufactured items (Harmonized System 6 +8).

-

7/26/2019 comertul extern

10/115

Avantajele competitive ale Romniei pe piaa interna UE

10

There have not been any drastic changes in the key strategic partnersfor key products: in 2001 thosewere Italy, Germany and Turkey and in 2011 three out of the seven key products arrived on the Germanmarket, with the rest going to Turkey, Hungary, Ukraine and France.

The level of competitiveness is analyzed at a 2-digit Harmonized System 5 classification and theselection included the top five key productscategories which in both years analyzed accounted for almost 50%

of total exports value, proving the strategic role they play in Romanias foreign trade. The analysis extended toa 4-digit level in groups highlighted key products exported by Romania for which it is interesting anassessment of the level of competitiveness and diversification compared with other countries. In 2011 theseproduct groups were: Parts and accessories for motor vehicles, Wires, cables and other electrical isolatedconductors; motor vehicles (including trucks); Electric wire telephone sets; Petroleum oils (not raw); Wasteand iron scrap, air pumps, vacuum hoods equipped with a fan . Hierarchy in terms of competitiveness on thedestination markets places the second largest export group, 8544 - Wires / isolated cables, as the topperformer in 2011.Although the most important in terms of exports, the automotive industry holds the lastposition, compared to the other products in terms of market share achieved: 2.9% in France and 3.2% inGermany for automobile parts and accessories. In terms of unit prices, the most expensive products exportedby Romania are electrical wire telephonysets,in most cases being a direct correlation between prices and themarket share obtained.

As regards the destination marketsfor key products, three out of the seven key products are importedby Germany and hold a market share of more than 3% on the German market. Other strategic markets areTurkey, Hungary, Ukraine and France. On the destination markets, Romania is present in the top 10exporters in all key export products. Shares in world exports range between 0.3% and 3.2%and morethan that, exporters of products with the best performance are in the top three suppliers of their strategicmarkets, proving a good capacity to compete internationally6.

Direct competitorsfor key exported products are mainly EU member states, the most frequent beingPoland, Italy and the UK. When corroborating within charts the market shares, unit prices and shares in worldexports, we observe that Romania ranks alongside competitors such as Poland, Slovenia and Japan in theautomobile industry, with Lithuania and Poland in the case of fuels, and is competing with Poland, Italy, UK,

Russia, Holland, the U.S. and Germany for the rest of the key exported products. Romania's export profile issimilar to the countries of Central and Eastern Europe, primarily to that of Poland. The price factor does notjustify in all cases the performance of countries in terms of market share gained. An in-depth market analysis,which is beyond the scope of this paper, may shed further light on the sources of competitive advantages.

Structural considerations regarding the added value created in Romania

The performance of external trade is inherently linked to the economic performance in general, andthere are numerous theories and practical applications that evaluate one side or the other of this obvious butcomplex relationship.

The conceptual framework of the analysis on the relationship between the performance of external trade

and the economic growth is set by the globalization process and its effects on the fragmentation of valuechains7; thus, the ultimate indicator of export competitiveness becomes the correlation between the exportperformance and the domestic income created throughout the value chain of its production. The actualconditions specific for a national economy favor the emergence and development of certain activities and their

5Harmonized System.6Forstrategic destinat ion markets, differences in terms of competitiveness towards their main competitors were assessed based on adiagram with three components: (1) the market share, (2) export unitary prices on the strategic destination market and (3) the share inworld exports for the specific product category.7A value chain can be defined by the number of activities and processes that are taken place in order to produce and distributetherespective goods to the end user.

-

7/26/2019 comertul extern

11/115

Studii de Strategie i Politici SPOS 2013

11

success on the global market, which will result in a specialization and structure at the level of nationaleconomies. Thus, the main assumption is that the exports competitiveness of an economy is higher, the moreit ensures larger incomes to its citizens through international exchanges.8

Between 2001-2011, but especially during the global economic boom between 2003 - 2007, theemerging economies and many of the developing countries have recorded growth rates far larger than those ofalready developed countries. This has resulted in a decrease of the global income shares of developedcountries. The biggest loss was reported by the USA and the most substantial gain was recorded by China.Globalization preceded the crisis, but the latter exposed the vulnerabilities of the global economic system andwas followed by an intensification of the rate with which the global income was redistributed in favor of theBRIC countries and the Rest of the World. But neither the boom, nor the crisis changed the fact that the bulkof the global incomes (the worldwide GDP) remained in the hands of the developed countries, although it hassignificantly dropped in the timeframe considered in this study.

Moreover, the percentage of the international GDP claimed by the countries forming the EU in 2012witnessed a major downfall since the beginning of the economic crisis, but this drop was preceded by a periodof growth. Romanias contribution to the worldwide GDP experienced a similar trend, although its worthnoting that Romanias position within the EU economy is steadily strengthening at the same rate as other

EU12 countries. When it comes to income per capita, the most important trend at the EU level is that ofconvergence. This is also the case of Romania and it developed along with a d ivergence of the structuralprofile of the Romanian economy to that of the EU after the moment of integration.9

The analysis of the structural changes can be made simply by looking at the distribution of the worldincomes (added value) of a certain industry, by country. In comparison with the global economy, it is worthmentioning that Romania is concentrating on labour intensive activities (leather, wood and food industry),where the danger of price competition from countries with emerging economies is very high. The total weightof Romanias GDP share in the EUs GDP is due first of all to the agriculture and raw materials sectors,followed by labour intensive industries.

In comparison with the reference year of the considered timeframe (2001), it is notable that the majority

of Romanian industries have improved their position on the European and world markets, especially in theperiod before the economic crisis. Yet, the most important increase of the Romanian economy within the EUduring the considered timeframe (2001-2011) is due to the labour intensive manufacturing industries with lowto medium technology, characterized by strongly fragmented and/or raw material or intermediary basic goodsproducing value chains. At the same time, the transport equipment industry (automotive industry), consideredas a medium to high technology, records the most substantial growth in global exports, being closely followedby a similar selection of low and medium tech manufacturing industries.

Analysis of internal incomes created by export manufacturers and their suppliers

For a better analysis of the integration of the Romania in the global economy and of the effect of thisintegration on national income, we use two indicators derived from the Input-Output analyses: the vertical

specialisation indicator and the income generated by participation to the global value chains.

The vertical specialisation indicator measures the so called external component of exports,representing the share of imports in total production associated to the exports vector, taking into consideration

8This is a somewhat simplifying vision, to the extent to which it doesnt take into consideration the sustainability of these incomes andtheir growth tendency over time. We try to compensate this limitation by analyzing a relatively important time period and by referringto the economic convergence process between Romania and the EU.9Conclusion derived based on the Krugman index which calculates the total differences between the proportion of the activity sectorsin two countries or regions.

-

7/26/2019 comertul extern

12/115

Avantajele competitive ale Romniei pe piaa interna UE

12

the entire value chain. As a response to the low labour cost in countries with emerging economies, themanufacturing industry from developed countries passed through a process of relocation of certain activities,which strengthened the creation of global production chains and has generated the growth of verticalspecialization in global economies. The bigger and more diversified a countrys economy is, the lower is itsvertical specialization, simply because a bigger country will buy intermediary goods more easily within itsown territory. As in the case of external trade, the vertical specializationof an economy has a rather strong

negative correlation with its size, but it is also influenced by other factors such as: the geographical position,the foreign investment flows the factors cost, the quality of the business environment, the adoption of acommon set of standards, the regime of intellectual property, the possibility of free movement of capital, thestructure of the economy etc.

Yet, the optimum positioning on the value chainresides in the specific process or activity which ensuresthe maximum income possible gained from trading the final product, as measured by the second indicator, theincome generated by participation to the global value chains. This indicator is negatively correlated, bydefinition, to the vertical specialisation indicator,but the intensity of the correlation is directly dependent ofthe share of the added value in the total production at sector level.. Thus, its possible, at least theoretically, forcountry with strongly specialization in an area in which it is very favorably positioned on the value chain, tocreate more internal revenues than a country of equal size, less specialized, but with less success in terms of

positioning.

In the considered timeframe, the EU Member States lost significant shares in terms of global trade andGDP and witnessed higher vertical specialization. But this doesnt mean that the revenues were lower, ratherthe contrary. The volume of EUs external exchanges increased, as well as the share of exports in GDP, whilethe trade balance upheld a positive trend and the actual incomes per capita continued to rise. Also theconvergence of per capita incomes an explicit objective for the EU continued to grow.

Unlike other parts of the world, the degree of vertical specialization in Romania declined between 2001and 2011 and the structure by country of origin of imports needed for the production of exports, , hasdiversified. Particularly, Romania has reduced its dependency on imports from EU area. Romanias verticalspecializationis below the average of what should be the specialization of an economy of the same size.

It is possible that, in the case of products exported by Romanian, a swift towards products with a shorterand less fragmented value chain may have occurred. It should not be forgotten nevertheless that localmanufacturers have also responded, in many cases successfully, to the exporters demand of intermediateproducts, diverting their demand from the competition within the EU, and creating themselves demand forintermediate products which offered further opportunities on the local market etc. Because this evolution isfollowed by a surge of Romanian products penetrating on the external markets, the decrease in verticalspecialization is consistent with economic growth, especially fuelled by the build up of internal demand.Additionally, Romania has witnessed a rise in terms of creating exports of other EU Member states, althoughthis contribution is small, being below of what its expected from an economy of this size.

When it comes to incomes generated on value chains through exports, in 2011 Romania retained almost

75%, while in the rest of the EU countries is creating around 16% of these incomes, meaning that 91,1% ofincomes created through the Romanian exports throughout their production chain, remains within the EU.

It is worth mentioning that although textile goods have lost their position as key sector for exports, thetextile industry still generates the largest export revenues for Romania and has the highest contribution to thegeneration of revenues in the EU. It is also worth noting that the position of the textile industry has decreaseddramatically between 2001 and 2011, in favour of the automotive industry. The decrease of the textile industryin the total revenues produced by Romanian exports is not accompanied by lower revenues per export unit,which means that it is a consequence of a contraction of production . The exact opposite process is occurring

-

7/26/2019 comertul extern

13/115

Studii de Strategie i Politici SPOS 2013

13

in the food industry sector, and to lesser extent, in the agriculture sector in general, whose share in the totalrevenues from exports rose, although revenues per export unit have dropped.

In general, it can be concluded that both in 2001 and 2011, three of the sectors producing key exportedproducts ranked in top in terms of incomes generated, whereas the other two have a minimal contribution togenerating revenues from export, also because the income per export unit is amongst the lowest. Overall, apositive trend for Romania is that the income created by the key product manufacturing sectors was greater in2011 that in 2001, but these sectors have a lower share in total incomes produced by exports in 2011 than in2001.

Generally, Romania was, rewarded in most cases for products with a competitive level of the unit pricewith gaining a fair market share and larger revenues created within the country. Nevertheless, a diversificationof the range of exported products is needed as well as a greater concentration on high tech products, byfocusing on the added value brought by research-development-innovation activities. The exploration of newdestination markets, outside Europe or the EU, is imperative in the current economic context.

Considerations regarding the effects of the economic crisis

While comparing 2001 and 2011 we must not neglect the non-linear aspect of the international economyevolution, marked by the ongoing crisis. This study extensively debates the impact of the crisis over allconsidered aspects. Countries have been unevenly affected, depending on their position as netcontributor/borrower and on the share of the constructions sector, but beyond any of these differences, thecrisis mostly affected demand and production without any specific and significant impact over productivity, atleast in the case of EU Member States. As a result, the exports, especially those directed towards less affectedeconomies, have resumed their growth, usually faster than the internal demand. This was also the case ofRomania. Important structural transformations have taken place, visible at country level, which followed therepositioning of producers on the specific value chains. This process has lead to a temporary decrease ofvertical specialization in many of the worlds countries.

Its interesting to note that even at EU level, the convergence of incomes per capita has increased, first

of all due to the recession in more developed countries, which suggests favorable economic circumstances forcountries with exports structure oriented towards basic cheaper goods and with less sophisticated financialsystems, such as Romania. Its important naturally, to what extent these countries will take advantage fromthe given circumstances in order to attain a higher position on the global value chains.

With regards to Romanias economic evolution and its external trade, the year 2009 marked a noticeableinflexion point. Like the majority of EU countries, Romanias economy witnessed a slowdown in 2009, in realterms, resuming its growth no sooner than 2011. The crisis followed two years of serious deterioration of tradebalance, due to the rise of consumption and low-cost credits, an important source for internal imbalances. Theyear 2009 marked the most significant drop in Romanias export prices throughout the entire analyzedtimeframe as well as critical changes in the structure of external trade.

Case studies

Following the analysis of statistical data, three performance vulnerabilities of the Romanian exportscould be revealed: (1) high dependency on price evolution and on the demand for the 5 products categoriescovering 50% of total exports, (2) the strong influence of the automotive industry on general performance 2out of the 7 key products are products of the automotive industry, (3) three of the key products are shipped tothe German market, Romania being exposed to the changes in the demand on this particular market. Thereason behind the selection of these case studies lies in the observations made in the previous chapters: theautomotive industry is the natural candidate, due to its role in the overall economic environment and in the

-

7/26/2019 comertul extern

14/115

Avantajele competitive ale Romniei pe piaa interna UE

14

performance of external sales, while the creative industries are worth analyzing not only because Romanianproducts are not embedding enough services but especially because the creative sector tends to accumulate alarge share of the incomes created along the value chain from by selling a final product. Each study casefollows the structural trends at the level of the industry, the localisation in Romania and in the EU, as well asthe performance at the sectorial level.

The automotive industry represents a significant sector of Romanias economy, which capturesextremely diverse resources and involves a very wide range of economic actors, reasons why it is consideredone of the most competitive industrial branches. The automotive industry in Romania is a cluster typeindustry, with high geographical concentration, limited predominantly to 3 counties. The sectors performancecan be synthesised thus: as regards the output productivity, Romania is below the average in the EU, yet at thesame level as the UK and by far ahead of Italy, Hungary, Czech Republic or Poland. The value addedgenerated by the auto industry (in absolute terms) in Romania is the lowest among analyzed countries.Although the sector is well supported in terms of research infrastructures, the research development innovation expenditures made by companies in the industry have been very low.

At EU level, the cluster classification by size, specialization and focus places Germany on the 1 stplace,demonstrating a high degree of the countrys competitiveness in the automotive industry. Leaders in Central

and Eastern Europe are the Czech Republic, Slovakia, Poland and Romania.

The statistics for Romania show that over the last period the creative industries had an overallascending trend and gained an important role at the macroeconomic level. At the level of creative industries, inRomania the sector with the highest contribution to the GDP, in terms of employment and labour productivityis the software sector. At the national level, the main feature of creative sectors, apart from other branches, isthat these are concentrated mostly at the level of a single region/county, in this case being located aroundBucharest.

Even if clusters in the creative industry are spread across the UE, there are large concentrations whichcover broad areas, such as the southern part of the UK, the Benelux countries and the Ile de France,transnational clusters being also present.

Describing the sector as a whole and making comparisons between various countries are difficultobjectives to achieve, due to the lack of economic statistics tools as well as of a harmonized classification ofthis type of activities at the EU level. Nevertheless, we can conclude that for Bucharest, Cluj, Timi, Braov,and Iai the values regarding the number of employees, the number of companies and the turnover are at leastsituated at the level of any locally developed economy in Europe. Moreover, all of Romanias regions aremuch better positioned on the employment in creative industries than on a general economic performancemeasured, for example, by the level of productivity.

-

7/26/2019 comertul extern

15/115

Studii de Strategie i Politici SPOS 2013

15

SINTEZ

Contribuia la literatura de specialitate

Lucrrea de fa contribuie la literatura dedicat analizei competitivitii exporturilor Romniei cu operspectiv nou asupra decadei 2001-2011, perspectiv rezultat din suprapunerea a dou analizecomplementare: analiza dinamicii performanei exporturilor i analiza veniturilor interne create deproductorii exporturilor i furnizorii acestora. Perioada analizat include anii de cretere economicmondial (n principal 2003-2007) i primii ani ai crizei economice mondiale (2009-2011). Momentulintegrrii europene al Romniei, anul 2007, este situat n mijlocul intervalului considerat.

Dinamica performanei exporturilor Romnieia fost evaluatprintr-o metodproprie compusdin treidirecii de cercetare distincte,: (1) evoluia ierarhiei produselor exportate n anii de referin2001 i 2011, (2)evoluia performanei produselor cheie exportate n 2001 i (3) poziia produselor cheie exportate n 2011 lanivelul anului 2001.

Analiza veniturilor interne create de productorii exporturilor i furnizorii acestorarealizeazpentruprima datpentru Romnia un studiu succint de poziionare pe lanul de valoare global n logica propusdeComisia Europeann ultimele sale douRapoarte de Competitivitate (2012 i 2013).

Rezultatele coroborrii celor dou analize pot fi utilizate pentru a discuta msura n care structuraactuala exporturilor contribuie la crearea veniturilor interne i poate astfel deveni utiln cadrul dezbateriiasupra identificrii unui brand de arpentru Romnia. n vederea realizrii acestui ultim obiectiv, am realizatdoustudii de caz detaliate pe dousectoare rezultate de referinale economiei romneti: autovehicule detransport rutieri industriile creative.

Piaa Unici globalizarea

O dimensiune fundamentalcu impact asupra analizei i a rezultatelor sale este apartenena economieiRomniei la piaa uniceuropean. Piata uniceuropeanjoacun rol catalizator n stimularea comerului attintra-european ct i cu ri non-membre i n acelai timp conduce la creterea capacitii de inovare, deproducie i creterea eficienei, ca urmare a sporirii dimensiunii spaiale n care firmele din UE activeazi acreterii resurselor la care acestea au acces. Mecanismul de integrare se va reflecta n cteva dimensiunicantitative pe care le urmrim, cum ar fi: convergena veniturilor, modificrile structurale (att la nivelulstructurii comerului exterior ct i sectorial), sincronizarea ciclurilor de afaceri, evoluia comerului intra-industrial. Ne strduim nssseparm, pe ct posibil, efectele integrrii europene de cele ale globalizrii ngeneral, deoarece considerm cse poate vorbi de o globalizare n douviteze i n sensul n care integrareaeuropeanprecede procesul de globalizare, att a bunurilor ct i a serviciilor.

Altfel spus, procesul crerii pieei unice i a integrrii economice este un proces concertat de dezvoltare

economic Pareto-optimal, ceea ce confer tuturor statelor membre un avantaj prin comparaie cu arenadeschisa confruntrii competitive pe piaa global. Din perspectiva acestui studiu, cele de mai sus nseamnc analiza de competitivitate a Romniei pe piaa UE nu nseamn numai identificarea acelor zone aleeconomiei cu performane pe pieele respective ale UE, dar i a acelora care contribuie, direct sau indirect, laperformana UE pe piaa global, deoarece acestea vor cpta, foarte probabil, amploare i pe viitor.

-

7/26/2019 comertul extern

16/115

Avantajele competitive ale Romniei pe piaa interna UE

16

Tendine mondiale majore ale exporturilor i poziia Romniei

Perioada 2001-2011 se caracterizeaz printr-o cretere substanial a pieei mondiale, o accelerare adinamicii exporturilor i importante mutaii n structura geografica acestora, n special ca urmare a prezeneitot mai semnificative a rilor emergente pe pieele internaionale i reducerea corespunztoare a ponderiieconomiilor avansate, inclusiv a Uniunii Europene pe ansamblul su. Dinamica UE rezult nsdin tendine

diferite pentru UE15 si UE12. Romnia i restul rilor din grupul UE12 au continuat screascn pondere ncomerul internaional, ceea ce sugereaz c rile care au devenit membre ale UE n cel de-al cincilea deintegrare european ncse afl, ca i economiile emergente, ntr-un stadiu de dezvoltare extensiv. Aceastcaracteristicse atenueazctre sfritul intervalului considerat. Pe de altparte, este de remarcat cgrupulrilor UE15 exportmai mult dect import, ceea ce devine i cazul grupului rilor UE12 n 2011, dar nu ial Romniei.

n ceea ce privete structura pe grupe mari de produs a exporturilor, aceasta a nregistrat doar schimb riminore - procesul de globalizare s-a desfurat ceva mai intens la nivelul produselor industriale prelucratedect al serviciilor (ponderea produselor industriale prelucrate n exporturile mondiale a crescut, n timp ce ceaa serviciilor a sczut uor). Ceea ce se observ ns este o cretere a ponderii exporturilor, n principal deproduse industriale prelucrate, destinate consumului intermediar - consecina creterii fragmentrii lanurilor

de producie la nivel internaional.

n acest context global dinamica poziiei de ansamblu a Romniei ntre 2001 i 2011 secaracterizeaz printr-o cretere important a ponderii rii n total exporturi mondiale, i ctre practic toatepieele. Legturile comerciale Romnia UE s-au dezvoltat cel mai rapid, consecina integrrii economice.Mai mult, gradul de convergen al comerului intra-industrial al Romniei cu UE27 a crescut semnificativ2008, ceea ce nseamncposibilitatea apariiei de ocuri asimetrice fade Uniunea Europeancontinusse reduc.

Creterea exporturilor Romniei a fost nsoitnsde o cretere chiar i mai importanta importurilor,ceea ce a rezultat ntr-o dinamica tot mai negativa balanei schimburilor externe, att vis-a-vis de economiamondialdar mai ales ctre restul rilor UE. Din acest motiv, deschiderea comercialctre alte piee trebuie

srmno prioritate a politicii comerciale.

Topul rilor UE importatoare de produse romneti (exclusiv servicii) era n 2011: Germania (1), Italia(2), Frana (3), Ungaria (4), Bulgaria (5), Marea Britanie (6), Olanda (7), Spania (8), Polonia (9), Austria (10).Germania este principalul partener comercial al Romniei. Cu mici variaii, aceast ierarhie s-a meninutconstantpe tot intervalul analizat. La nivelul anului 2011, Romnia nregistra surplus comercial cu 7 statemembre ale UE i deficit pe relaia cu celelalte 19. Frana este ara cu care Romnia nregistreaz cel maiimportant surplus comercial, ceea ce reflect ntr-o mare msur performana la export a mainilor iechipamentelor de transport.

Considerente structurale referitoare la exporturile Romniei

Din punct de vedere structural, a avut loc o dublare a ponderii Romniei n exporturile mondiale deproduse agricole (cu creterea cea mai importantctre UE15), i creteri importante ale exporturilor de bunuriindustriale (mai ales ctre UE12, dar i ctre UE15), ca i a exporturilor de servicii de pia(n primul rndctre rile BRIC i Restul lumii).

Potenialul agricol este totui insuficient exploatat, ceea ce rezulti din balana negativa comeruluicu bunuri alimentare, buturi i tutun, dei agricultura ocupo parte importanta forei de munc. Agriculturase aflevident pe lanul de valoare al industriei de alimente i buturi, sector din ce n ce mai important pentruRomnia n ceea ce privete ponderea n valoarea adugatmondial i european, dar nu i n termeni decomerexterior. Industria de alimente i buturi are un nivel de fragmentare mediu, dar ponderea consumului

-

7/26/2019 comertul extern

17/115

Studii de Strategie i Politici SPOS 2013

17

intermediar din sectorul agricol romnesc a sczut semnificativ ntre 2001 i 2011. n prezent, mareamajoritate a produciei agricole este destinatdirect consumului final al gospodriilor. Agricultura Romnieieste n prezent susinutde politica agricolcomun, dar pentru meninerea avantajului astfel creat dezvoltareaacestui sector va trebui sse bazeze pe creterea calitii i sustenabilitii produselor agricole i exploatareanielor, prin diversificare i prelucrare.

Comerul internaional cu servicii de piaeste de asemenea un caz special. Ca efect al stadiului actualal globalizrii, ponderea exporturilor n total producie i valoare adugat de servicii de pia a crescut nmajoritatea macro-regiunilor, inclusiv UE12, dar nu i n Romnia. Avnd n vedere contextul liberalizriipieelor serviciilor n UE i faptul cponderea serviciilor de piaproduse n Romnia n producia i valoareaadugatmondiala crescut puternic ntre 2001 i 2011, ar fi util de investigat existena unui potenial avantajcompetitiv al Romniei pe piaa internaional n acest domeniu i a eventualelor bariere care s permitrealizarea acestuia. Este important de observat c, prin comparaie cu alte ri ale UE, bunurile produse nRomnia nglobeaz ponderea cea mai mic de servicii n consumul intermediar, ceea ce nseamn cserviciile n cretere sunt mai ales destinate consumului final.

n ceea ce privete bunurile industriale prelucrate, se detaeaz prin dinamica ascendent exporturileRomniei de autovehiculele care s-au dublat pe intervalul considerat. Acest lucru se datoreaz atragerii de

ctre Romnia a marilor productori de automobile, n special Renault, responsabil pentru cea mai mare partea exporturilor romneti. A doua categorie de bunuri exportate preponderent de Romnia sunt alte produseindustriale, care mpreun cu autovehiculele, reprezentnd aproape trei sferturi din totalul exporturilor deproduse industriale prelucrate. La polul opus se situeazprodusele chimice, cu deficit comercial n cretere, pefondul scderii puternice a competitivitii i performanelor industriei petrochimice locale.

Nu n ultimul rnd este de remarcat cRomnia exportmai multe materii prime dect import, ceea cerelevfaptul cpoziionarea rii pe lanul de valoare ar putea fi mbuntitcu resursele existente. n acelaitimp, bunurile de consum final au dominat structura importurilor, ceea ce a defavorizat suplimentar pozi iaeconomiei romneti n contextul crizei mondiale recente. Totui, cu excepia anilor 2002 i 2009, Romnia acunoscut o perioad de mbuntire relativ a performanelor economice i a competitivitii bunurilorexportate, situaie reflectat de raportul de schimb supraunitar. Din acest punct de vedere anii 2004, 2005,

2006 i 2007 au adus cele mai bune rezultate, iar dupdeclanarea crizei economice anul 2010 a marcat oameliorare a acestui raport.

Analiza dinamicii performanei exporturilor Romniei

Ierarhia produselor de top exportate s-a schimbat ntre 2001-2011, cele 3 principalele clase de produseexportate n 2011 avnd o pondere mic n urm cu zece ani. Schimbrile structurale au adus n topautovehiculele i grupa de produse utilaje, reactoare nucleare, boilere, n paralel cu ieirea din top a produselortextile i produselor de pielrie i nclminte (prezente n 2001). n 2011, grupa de produse echipamenteelectrice i electronice era principala grupde produse exportatde Romnia. A avut loc o scdere a ponderiibunurilor de tehnologie joas n favoarea celor de tehnologie medie, ca i creterea bunurilor tehnologicintensive. Totui, din perspectiva cotelor de pia, performanele produselor cheie exportate n 2001 au fost

cu mult superioare celor reuite de produsele cheie exportate n 2011. Modificrile nu au fost drastice nceea ce privete partenerii strategicipentru produsele cheie: n anul 2001 acetia au fost Italia, Germania i,Turcia, iar n 2011 trei dintre cele apte produse cheie a ajuns pe piaa german, restul au mers n Turcia,Ungaria, Ucraina i Frana.

Gradul de competitivitate a fost analizat pornind de la o clasificare de 2 cifre SA i au fost selectateprimele 5 clase de produse cheie ce au reprezentat n ambii ani analizai aproape 50% din totalul valoriiexporturilor, demonstrnd rolul strategic pe care acestea l au n ceea ce privete vnzrile externe aleRomniei. Extinderea analizei la un nivel de 4 cifre n cadrul grupurilor a reliefatprodusele cheieexportate de

-

7/26/2019 comertul extern

18/115

Avantajele competitive ale Romniei pe piaa interna UE

18

Romnia pentru care se justifico analiza nivelului de competitivitate i diversificare n comparaie cu alteri. n 2011 acestea au fost:Piese i accesorii pentru autovehicule; Srme, cabluri i ali conductori electriciizolai; Autoturisme (inclusiv autocamioane); Aparate electrice de telefonie pe fir; Uleiuri din petrol (nubrute); Deeuri i resturi feroase; deeuri lingotate din fier sau din oel; Pompe de aer, de vid, hote prevzutecu un ventilator. Ierarhia n termeni de competitivitate pe pieele de destinaie plaseazcea de-a doua maregrupde export, 8544 - Fire/cabluri izolate, ca cel mai bun performer n 2011. Dei cea mai importantn

ceea ce privete exporturile, industria auto ocupultimul loc, fade celelalte produse de comparaie, ntermeni de cotde piaobinut: 2,9% n Frana pentru automobile i 3,2% n Germania pentru piese iaccesorii pentru autovehicule. n materie de preuri unitare, cele mai scumpe produse exportate de Romniadintre cele analizate sunt aparatele electrice de telefonie pe fir, n majoritatea cazurilor existnd o corelaiedirectntre preurile practicate i cota de piaobinut.

n ceea ce privete pieele de destinaiepentru produsele cheie, trei din cele apte produse cheie suntimportate de Germania i au pe piaa german o cot de pia mai mare de 3%. Alte piee strategice suntTurcia, Ungaria, Ucraina i Frana. Pe pieele de destinaie, Romnia este prezentn top 10 exportatori ncazul tuturor produselor cheie de export. Ponderile n exporturile mondiale variazntre 0.3% i 3.2%imai mult dect att, exportatorii produselor cu cele mai bune performane se situeazn primii trei furnizori deproduse pentru pieele lor strategice dovedind o buncapacitate de a concura pe plan internaional.

Competitorii direcipentru produsele cheie exportate sunt cu preponderen ri membre ale UE, ceimai frecveni fiind Polonia, Italia i Marea Britanie. Corelnd cotele de pia, preurile unitare i ponderea nexporturile mondiale n cadrul unor diagrame, se observ ca Romnia se plaseaz alturi de competitoriprecum Polonia, Slovenia i Japonia n cazul industriei auto, pe poziie similarcu Lituania i Polonia n cazulcombustibililor i concurnd cu Polonia, Italia, UK, Rusia, Olanda, SUA i Germania pentru celelalte produsecheie. Profilul de export al Romniei este similar rilor Europei Centrale i de Est, n principal cu cel alPoloniei. Factorul prenu justificn toate cazurile performana rilor n materie de cotde piadobndit. Oanaliz detaliat de pia, care trece ns de obiectivele acestei lucrri, poate oferi explicaii suplimentaredespre sursele avantajelor competitive.

Considerente structurale referitoare la valoarea adugatcreatn Romnia

Performana comerului exterior este legat intrinsec de performana economic n general, i existnumeroase teoretizri i aplicaii practice care evalueaz o faet sau alta a acestei relaii evidente, darcomplexe.

Cadrul conceptual al analizei legturii dintre performana comerului exterior i creterea economiceste impus de procesul globalizrii i efectele sale asupra fragmentarii lanurilor de valoare; indicatorul ultimal competitivitii exporturilor devine astfel corelaia dintre performana exporturilor i venitul intern realizatpe ntregul lande valoare al produciei acestora.

Condiiile concrete specifice unei economii naionale favorizeaz emergena i dezvoltarea anumitoractiviti i succesul lor pe piaa mondial, ceea ce rezultn specializare i structurla nivelul economiilor

naionale. Premisa de bazeste deci co economie este cu att mai competitivla export, cu ct asigurprinintermediul schimburilor internaionale venituri mai mari cetenilor si.

n perioada 2001-2011, dar n special n timpul boom-ul economic mondial din 20032007, economiileemergente i multe dintre statele n curs de dezvoltate au nregistrat rate de cretere mult mai mari dect riledezvoltate. Aceasta a rezultat ntr-o scdere a ponderii veniturilor globale din rile dezvoltate. Cel mai mult apierdut SUA, iar ctigul cel mai substanial l-a nregistrat China. Globalizarea a precedat criza, dar aceastadin urma adus n prim-plan vulnerabilitile sistemului economic mondial, i a fost nsoitde o accentuare aritmului redistribuirii venitului global n favoarea rilor BRIC i din Restul Lumii. Dar nici boom-ul, nici

-

7/26/2019 comertul extern

19/115

Studii de Strategie i Politici SPOS 2013

19

criza nu a schimbat faptul ccea mai mare parte a veniturilor globale (PIB-ul mondial), rmne n minilerilor dezvoltate, dei a sczut semnificativ n perioada analizatn aceastlucrare.

Si ponderea deinut n PIB-ul mondial de grupul de ri care formau Uniunea European n 2012 anregistrat o scdere marcat de la nceperea crizei economice, dar aceast scdere a fost precedat de operioad de cretere. Ponderea Romniei n PIB-ul mondial a cunoscut o tendin similar, dei este deremarcat c, n paralel, poziia Romniei n cadrul economiei UE se consolideazuor, tendincomun cucelelalte ri UE12. n ceea ce privete venitul pe locuitor, tendina cea mai importantla nivelul UE este ceade convergen. Aceasta este valabil i n cazul Romniei, i a avut loc n paralel cu o divergena profiluluistructural al economiei romneti fade cel al UE dupmomentul integrrii.

Analiza schimbrilor structurale se poate face privind pur i simplu distribuia pe ri a veniturilor(valorii adugate) mondiale ale unei anumite industrii. Comparativ cu economia mondial, este de remarcatfaptul c Romnia se concentreaz pe activiti intensive n for de munc (pielrie, lemn, industriealimentar), unde pericolul competiiei de pre din partea rilor cu economii emergente este foarte mare.Ponderii PIB-ului Romniei n PIB-ul UE se datoreaz ns n primul rnd agriculturii i materiilor prime,urmate de industriile intensive n forde munc.

n comparaie cu anul de referin al perioadei considerate (2001) este de remarcat c majoritateaindustriilor romneti i-au mbuntit poziia pe piaa mondiali european, mai ales n perioada de dinaintede criza economic. Totui, creterea cea mai importanta economiei romneti n cadrul UE pe intervalulconsiderat (2001-2011) se datoreaz industriilor prelucrtoare cu utilizare intensiv a forei de munc, detehnologie medie i joas, caracterizate de lanuri de valoare puternic fragmentate i/sau productoare dematerii prime i bunuri intermediare de baz. n acelai timp, industria productoare de echipament detransport (autovehicule), consideratde tehnologie medie-nalt, nregistreazcreterea cea mai semnificativn total mondial, fiind urmat nsde o selecie similar de industrii manufacturiere de tehnologie medie ijoas.

Analiza veniturilor interne create de productorii exporturilor i furnizorii acestora

Pentru analiza msurii n care economia Romniei este integrat n economia mondial i care esteefectul acestei integrri asupra veniturilor naionale, folosim doi indicatori derivai din analizele Input-Outputi anume: indicele de specializare pe verticali venitul creat prin integrarea in lanul global de valoare.

Indicele de specializare pe vertical msoar aa numita component extern a exporturilor, adicponderea importurilor n total producie asociatcu vectorul exporturilor, lund n considerare ntreg lanul devaloare. n rspuns la oferta de forde muncieftindin rile cu economii emergente, industria prelucrtoaredin rile dezvoltate a trecut printr-un proces de delocalizare a anumitor activiti, ceea ce a accentuat procesulde creare a lanurilor de producie globale i a generat creterea specializrii pe verticala economiilor lumii.Cu ct economia unei ri este mai mare i mai diversificat, cu att specializarea sa pe vertical este mairedus, pur i simplu pentru c o armai mare va contracta mai uor produse intermediare de pe teritoriulpropriu. Ca i n cazul comerului exterior, specializarea pe vertical a unei economii este relativ puternic

corelatnegativ cu dimensiunea sa, dar este influenati de ali factori cum ar fi: poziionarea geografic,fluxul investiiilor strine, costul factorilor, calitatea mediului de afaceri, adoptarea unui sistem comun destandarde, regimul proprietii intelectuale, libertatea de circulaie a capitalului, structura economiei etc.

nsoptimul poziionrii pe lanul de valoare este n acel proces sau activitate care asigurmaximulposibil de venituri din comercializarea produsului final, msurate prin cel de-al doilea indicator, venitulcreatprin integrarea n lanul global de valoare. Acest indicator este prin definiie corelat negativ cu indicatorul despecializare pe vertical, dar intensitatea corelaiei este direct dependentde ponderea valorii adugate n totalproducie la nivel de sector. Astfel este posibil, cel puin teoretic, ca o ar puternic specializat ntr-un

-

7/26/2019 comertul extern

20/115

Avantajele competitive ale Romniei pe piaa interna UE

20

domeniu n care este foarte favorabil poziionat pe lanul de valoare, s creeze mai multe venituri internedect una de dimensiune egalmai puin specializat, dar cu mai puin succes n poziionare.

n intervalul consideratrile UE au pierdut pondere importantn comerul i n PIB-ul mondial, i aucrescut n specializarea pe vertical. Dar asta nu a nsemnat car fi ctigat mai puin, ci dimpotriv. Volumulschimburilor externe ale UE a crescut, ca i ponderea exporturilor n PIB-ul propriu, balana comercials-a

meninut pozitiv iar veniturile reale pe locuitor au continuat s creasc. A crescut inclusiv convergenaveniturilor pe locuitor, obiectiv explicit al UE.

Spre deosebire de alte zone ale lumii, gradul de specializare pe verticala Romniei a sczut ntre 2001i 2011, iar structura pe ara de origine a importurilor necesare pentru producerea exporturilor s-a diversificat.n particular este de remarcat ca Romnia i-a redus dependena de importurile din zona UE. Specializarea pevertical a Romniei este sub ceea ce ar fi pe medie specializarea pe vertical a unei economii de aceeaidimensiune

Este posibil ca n cadrul grupelor de produse exportate de Romnia s se fi produs o tranziie ctreproduse cu lande valoare mai scurt sau mai puin fragmentat. Dar nu trebuie uitat i faptul cproductoriilocali au rspuns n multe cazuri cu succes cererii de produse intermediare ale exportatorilor, n sensul n care

au deturnat cererea acestora de la concurena din UE, crend la rndul lor cerere de produse intermediare carea oferit oportuniti pe piaa local etc. Deoarece aceast evoluie este nsoit de creterea penetrriiproduselor romneti pe pieele externe, scderea specializrii pe vertical este consistent cu cretereaeconomic, mai ales alimentat de creterea cererii interne. n plus, Romnia a nregistrat o contribuie ncretere la producerea exporturilor altor ri membre UE, dei aceastcontribuie este mic, apreciatla subceea ce ar fi de ateptat de la o economie de dimensiunea sa.

n ceea ce privete veniturile pe lanurile de valoare create prin exporturi, n 2011 Romnia reineaproximativ 75%, n timp ce n restul rilor UE se creazaproape 16% din aceste venituri, adic91,1% dinveniturile create prin exporturile romneti pe ntregul lor lande producie rmne pe teritoriul UE.

Este de remarcat cdei produsele textile au pierdut poziia de sector cheie pentru exporturi, industria

de textile genereaz nccele mai mari venituri din export pentru Romnia, i alimenteaz n cea mai maremsur crearea de venituri n UE. Este de asemenea de remarcat c poziia industriei de textile a sczutdramatic ntre 2001 i 2011 n favoarea industriei de mijloace de transport. Scderea ponderii industriei textilen total venituri produse prin exporturile din Romnia nu este nso itde o scdere a veniturilor pe unitate deexport, ceea ce nseamn c este consecina unei scderi a produciei. Procesul exact contrar se petrece lanivelul industriei alimentare, i, ntr-o mai micmsur, a agriculturii n general, a crei pondere n venituriletotale din exporturi a crescut, dei veniturile pe unitate de export au sczut.

n general, se poate conchide c att n 2001 ct i n 2011, trei dintre sectoarele productoare deproduse cheie se situeazn topul sectoarelor din punctul de vedere al veniturilor pe care le genereaz, n timpce celelalte douau o contribuie minimla crearea veniturilor din export, i pentru ca venitul creat pe unitatede export este printre cele mai mici. Pe ansamblu, o tendinpozitivpentru Romnia este cvenitul creat n

Romnia de sectoarele productoare de produse cheie pe unitate de export este mai mare n 2011 dect n2001, dar acestea acopermai puin din veniturile totale realizate din exporturi.

n general, Romnia a obinut, n cele mai multe cazuri, recompensa pentru produsele cu un nivelcompetitiv al preului unitar prin obinerea unei cote de piabune i unor venituri mai mari create n interiorulrii. Totui, este necesaro diversificare a gamei de produse exportate i o concentrare mai mare pe produselehigh-tech, punnd accent pe valoarea adugat adus de activitile de cercetare-dezvoltare-inovare.Prospectarea de noi piee de destinaie din afara Europei sau a UE este obligatorie n contextul economicactual.

-

7/26/2019 comertul extern

21/115

Studii de Strategie i Politici SPOS 2013

21

Consideraii privind efectele crizei economice

Comparaia dintre anul 2001 i 2011 nu trebuie spiarddin vedere caracterul non-linear al evoluieieconomiei mondiale marcatde criza n desfurare. Lucrarea dezbate pe larg impactul crizei asupra tuturoraspectelor considerate. rile au fost afectate diferit n funcie de poziia lor de creditori/debitori nei i deponderea sectorului de construcii, dar dincolo de aceste diferene criza a afectat puternic cererea i produciafrun impact sistematic i semnificativ asupra productivitii, cel puin n cazul rilor UE. Drept urmare,exporturile, mai ales cele ctre economii mai puin afectate de criz, i-au reluat creterea, de obicei chiar mairapid dect cererea intern. Acesta a fost i cazul Romniei. Au avut loc mutaii structurale importante vizibilela nivel de ar, care au urmat repoziionarii a productorilor pe respectivele lanuri de valoare. Acest proces adus la o scdere temporara specializrii pe verticaln multe dintre rile lumii.

Interesant este i cla nivelul UE, convergena veniturilor pe locuitor a crescut, n primul rnd datoritrecesiunii din rile mai dezvoltate, ceea ce sugereazo conjunctureconomicfavorabilrilor cu structuraexporturilor orientatctre produse de baz, mai ieftine i cu un grad de sofisticare al sistemului financiar mairedus, cum este i cazul Romniei. Important este, bineneles, n ce msuraceste ri profitde conjuncturadatpentru a atinge o poziie superioarpe lanurile de valoare globale.

n ceea ce privete evoluia economiei Romniei i a comerului su exterior, anul 2009 a marcat oevident punct de inflexiune. Asemeni marii majoriti a rilor UE, economia Romniei a nregistrat n 2009scdere n termeni reali, creterea relundu-se abia n 2011. Criza a urmat unor doi ani n care balanacomercials-a nrutait dramatic, n mare msurca urmare a creterii consumului i a creditelor ieftine sursaimportanta dezechilibrele interne. Anul 2009 a fost anul cu cea mai importantscdere a preurilor de exportale Romniei pe toata perioada analizat i a marcat schimbri importante la nivelul structurii comeruluiexterior.

Studii de caz

n urma analizei datelor statistice pot fi reliefate trei vulnerabiliti ale performanei exporturilorromneti: (1) dependena ridicat de evoluia preului i a cererii pentru cele 5 categorii de produse ce

nsumeaz 50% din totalul exporturilor, (2) strnsa influen pe care performana industriei auto onregistreazasupra performanei generale - 2 din cele 7 produse cheie sunt produse ale industriei auto, (3) treidintre produsele cheie sunt livrate pe piaa german, Romnia fiind expusevoluiei cererii de pe aceastpia.Alegerea studiilor de caz este justificatde observaiile din capitolele anterioare: industria de autovehicule estecandidatul natural, datoritrolului acesteia n piesajul economic general i n performaa vnzrilor externe, ntimp ce industriile creative sunt demne de analizat nu numai pentru c produsele romneti nu nglobeazsuficiente servicii, dar mai ales pentru czona de creaie tinde sacumuleze mare parte din veniturile create pelanul de valoare din vnzarea unui produs final. Fiecare studiu de caz urmrete tendinele structurale lanivelul industriei, localizarea n Romnia i n UE, ct i performanele la nivel sectorial.

Industria auto reprezintun sector semnificativ pentru economia Romniei, aceasta captnd resurseextrem de variate i implicnd o gamfoarte larga actorilor economici, motive pentru care este considerat

ca fiind una dintre cele mai competitive ramuri industriale. Industria auto din Romnia este una de tipcluster,cu o concentrarea geograficridicati limitatn principal n 3 judee. Performana sectorului poatefi sintetizat astfel: n ceea ce privete productivitatea muncii, Romnia este sub media UE, ns este pe opoziie similar cu Marea Britanie i cu mult peste Italia, Ungaria, Cehia sau Polonia. Valoarea adugatgeneratde industria auto din Romnia (n termeni absolui) este cea mai sczutdin rndul rilor analizate.Dei sectorul este bine susinut din punct de vedere al structurilor de cercetare, cheltuielile cu CDI realizate decompaniile din industrie au fost foarte sczute.

-

7/26/2019 comertul extern

22/115

Avantajele competitive ale Romniei pe piaa interna UE

22

La nivel UE, clasificarea clusterelor n funcie de mrime, specializare i focus plaseazGermania pelocul nti, demonstrnd gradul de ridicat de competitvitate al rii n industria auto. Lideri n Europa Centrali de Est sunt Cehia, Slovacia, Polonia i Romnia.

Datele statistice pentru Romnia aratcn ultima perioadindustriile creativeau avut n general untrend ascendent i i-au ctigat un rol important la nivel macroeconomic. n cadrul industriilor creative, n

Romnia ramura cu cea mai mare contribuie din punct de vedere al contribuiei la PIB, al ocuprii forei demunc, al productivitii muncii, este sectorul de software. La nivel naional, principala caracteristic asectoarelor creative este aceea c, spre deosebire de celelalte ramuri, acestea sunt concentrate preponderent lanivelul unei singure regiuni/unui singur jude, n acest caz fiind localizate n principal la nivelul Bucuretiului.

Chiar dacclusterele creative sunt distribuite pe ntreg teritoriul european, existconcentraii mari careacoperzone largi, cum ar fi partea de sud a Angliei, rile Benelux i Ile de France, cele transnaionale fiindde asemenea prezente.

Descrierea sectorului n ansamblu i realizarea de comparaii ntre state sunt obiective dificil de realizatdatorit lipsei instrumentelor de statistic economic i a unei clasificri armonizat la nivelul UE aactivitilor de acest tip. Putem concluziona nsfaptul cpentru Bucureti, Cluj, Timi, Braov i Iai valorile

privind numrul de angajai, numrul de firme i cifra de afaceri sunt cel puin la nivelul oricrei economiilocale dezvoltate din Europa. De asemenea, toate regiunile Romniei se claseazmult mai bine n ierarhiaocuprii n domenii creative dect ntr-o ierarhie a performanei economice msuratde exemplu prin nivelulproductivitii.

-

7/26/2019 comertul extern

23/115

Studii de Strategie i Politici SPOS 2013

23

INTRODUCERE

Specialiti din diverse domenii au ncercat sdefineascsau sconstruiascreprezentri ale conceptului

de competitivitate, iar prima caracteristicce i deosebete este perspectiva asupra competitivitii: cauzsauefect, mijloc de obinere a performanei sau rezultat adicperformana nsi? n aceasta lucrare considermcompetitivitatea ca un atribut derivat din eficiena utilizrii factorilor, esenial pentru crearea de ct mai multevenituri, deci, ca n Gheorghiu et al. (2011), un concept nrudit productivitii. Aceasta este, n mare, idefiniia competitivitii pe care o propune, ntre alii, Comisia European (2005): capacitatea firmelor,ramurilor, regiunilor, naiunilor i asociaiilor supranaionale expuse concurenei internaionale de a asigura orentabilitate relativnalta factorilor de producie [] pe baze durabile.

n general, vom porni de la premisa primara agregrii de la stnga la dreapta n relaia (1): produs companie sector de activitate, respectiv, produsele sunt rezultatul activitii companiilor, mai multecompanii cu acelai profil formeazun sector de activitate. Companiile active pe un anumit teritoriu constituieo economie regional/ naional, cu o anumitstructursectorial. n aceastlogic, o economie competitivva fi pur i simplu o economie care produce bunuri i servicii competitive pe piaa mondial.

Cu toate acestea, termenul de competitivitate are accepiuni specifice atunci cnd ne referim la diversenivele de agregare: produse, companii, sectoare economice, regiuni sau ri. La fiecare dintre aceste nivele,definirea termenului se concentreaz sau trimite ctre alte concepte: abilitile/ competenele companiilor,calitatea mediului de afaceri, comerul internaional, standardul de via, preul etc. (Belkacem, 2002). Fiecaredintre aceste nivele antreneazactori, msuri de politici strategii diferite. Decidenii politici sunt n generalinteresai de nivelul macroeconomic, pentru a se putea poziiona n balana puterii economice mondiale, dar ide nivelul microeconomic, asumndu-i obiectivul de a asigura competiia liberpe pia, a mbunti mediulde afaceri i a stimula inovarea i dezvoltarea sustenabil. Specializarea sectorial apare mai degrab ca orezultant, un indicator al modului n care condiiile concrete de pe pia, favorizeazemergena i dezvoltareaanumitor activiti, mai ales n condiiile globalizrii i economiei libere.