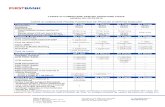

Text 6-Sem.1_Dobanda Zero, Industria Alimentara La Adapost de Criza Economic Reports

-

Upload

roxana-tudose -

Category

Documents

-

view

3 -

download

0

description

Transcript of Text 6-Sem.1_Dobanda Zero, Industria Alimentara La Adapost de Criza Economic Reports

Curs practic engleza_III R-E IFR_ sem.I_ Lect.dr. Ileana Chiru- Jitaru

Text 6 - Economic translation(Tudose) Stoian Roxana

America, dobnd zero!Autor Marius Guta

Vestile proaste dinspre piata americana par a se intensifica, din pacate, fapt care influenteaza intreaga economie mondiala.

Ultima dintre acestea este aceea potrivit careia economia americana se confrunta cu pericolul deflatiei. Aparent, deflatia, respectiv scaderea indicelui preturilor de consum, ar putea fi considerata un lucru bun pentru consumatori, dar pe termen lung efectele sale asupra economiei pot fi devastatoare in contextul in care companiile nu isi mai pot acoperi, prin pret, cheltuielile.

Ca urmare, Federal Reserve (Banca Centrala Americana) ia in calcul reducerea dobanzii de politica monetara pana la... zero. In acest fel se spera ca se va stimula creditarea, deci si consumul si, in consecinta, cresterea preturilor ceea ce va combate deflatia.

Pe de alta parte, institutiile de credit americane nu se afla intr-o situatie prea buna, ba chiar dimpotriva, fapt care determina o scadere continua a capitalizarii bursiere, multe dintre acestea, printre care nume grele precum AIG, Bank of America ori Citigroup inregistrand pierderi considerabile la Bursa de la New York.

America, zero interest!By Marius Guta

The bad news from the America market seem to intensify a fact which influences unfortunately the whole global market.The last one ot these is that according which the American economy is confronting with the danger of deflation. Apparently, the deflation, related to the dropping of the consumer market coefficient, could be considered a good thing for consumers, but , in the long run, its effects on the economy can be devastating , in the context in which companies cannot anymore pay its way.As a result, the Federal Reserve is taking into account the reduction of the monetary police interest up to zero.In this way they hope they will stimulate the lending and the consuming, thence, the rising of the prices which will combat the deflation.On the other side, the American credit institutions are not in a very good position/ situation, on the contrary, fact which determines a continuous drop of the stock capitalization, many of them, including big names such as: AIG, Bank of America or Citigroup having considerable loss at the New York Stock Exchange.Industria alimentar, la adpost de criz?

Autor Cosmina Ionita 21 Noiembrie 2008

Efectele crizei se vor simti din plin si in Romania anului 2009. Specialistii spun ca intreaga economie va avea de suferit. Cu toate acestea, sunt si cateva sectoare mai putin afectate de recesiune.

Laurian Lungu, analist economic la Grupul de Economie Aplicata, spune ca, in vremurile actuale de criza si incertitudine economica, volatilitatea a crescut foarte mult pe pietele de capital. Sectoarele militar, farmaceutic si alimentar se afla printre cele mai ferite de criza.Acestea sunt, in general, sectoarele a caror activitate au o corelatie cat mai mica cu ciclul economic. Sectorul apararii/militar este un exemplu. Mai putem aminti sectoarele care genereaza produse de necesitate, indispensabile traiului, cum ar fi cel alimentar. Un alt domeniu care are o expunere mai redusa a riscului in vremuri de criza este cel farmaceutic. In afara de acestea, investitiile in firme care au lichiditati, datorii putine si un cash-flow puternic pot fi o alta solutie. In cazul acesta, insa, este necesara o analiza preliminara, pentru fiecare companie in parte, a explicat Laurian Lungu.

Pe de alta parte, analistul economic Ilie Serbanescu considera ca, din punctul de vedere al populatiei, furturile sunt cel mai putin lovite de criza, acestea devenind o institutie in Romania. Se traieste din asta si sunt oameni care au vile, masini si iahturi din furturi. Este vorba de beneficiarii achizitiilor publice montate si suprafacturate, de la borduri la deszapeziri, a declarat, pentru Capital.ro, Ilie Serbanescu.

El mai spune ca vor fi mai protejate sectoarele legate de viata cotidiana si de necesitatile imperioase ale oamenilor. Serviciile de utilitati publice si cele de asigurare a produselor alimentare sunt doua astfel de exemple.

In schimb, cel mai afectat va fi retailul legat de bunurile de folosinta indelungata. Din punctul de vedere al industriilor mari, lucrurile sunt mai complexe. Primele lovite vor fi sectoarele care au crescut in ultimul timp: serviciile si constructiile, a concluzionat Serbanescu.

Sorin Minea, presedintele Asociatiei Romane a Carnii, este de alta parere. El spune ca niciun sector nu poate fi ferit de criza economica, cu atat mai putin industria alimentara.Potrivit acestuia, o parte dintre multinationale isi retrage, deja, unitatile de productie din Romania, iar firmele care nu au putere financiara pot sa dispara.

Totodata, nu vor lipsi nici disponibilizarile. Cei care vor inchide fabricile, vor trebui sa disponibilizeze. Pe de alta parte, va fi o crestere a lucrului la negru. Pentru ca cei care vor exploda pe piata neagra, vor avea nevoie de muncitori. Dar cei care au foarte multi muncitori si lucreaza pe piata neagra, ii platesc la negru. Deci, va aparea un somaj, dar un fals somaj, intr-o prima faza. Undeva spre jumatatea anului viitor, s-ar putea sa apara disponibilizari reale, a explicat, pentru Capital.ro, Sorin Minea.

The food industry, away from the economic crisis?

By Cosmina Ionita

21 November 2008The effects of the crisis will be fully felt in Romania too in 2009. The experts are saying that the entire economy will het hurt. Anyway, there are some sectors less affected by the recession. Laurian Lungu, economic anayst at the Applied Economy Group, is saying that in these times of economic crisis and economic uncertainty the volability has increased a lot on the capital market. The military, pharmaceutic and food sectors are the most away from the economic crisis. These are, generally, sectors whose activity have a correlation as small as possible with the economic circle. The military sector is an example. We can mention sectors which generate necessary products indispensable to living, such as the food sector. Another domain which has a smaller risk exposure to crisis times like the pharmaceutic sector. Apart from these, investments in companies which have cash, small debts and a strong cash-flow can be a solution.On the other side, the economic analyst Ilie Serbanescu considers that , from the population point of view, thefts are the less hit by the crisis, these becoming an institution in Romania: You can live out of this and there are people who have mansions, cars and yachts from stealing. Its about beneficiaries of public acquisitions mounted and overcharged from borders to snow removal declared Ilie Serbanescu in Capital.roSorin Mihea, the president of the Romanian Meat Association is of the different opinion. He is saying that no sectors can be hidden from the economic crisis, least of all, the food industry. According to this, a part of multinationals have already withdrawn the production units from Romania, and the companies which dont hace financial power can disappear.At the same time, layoffs cant miss: Those who will close factories, will have to lay off people. On the other side, there will be a growth of the work under the table. Because those who have a lot of workers and are working on the black market , are paying them under the table. So, in the first phase, there will appear unemployment, but a false one. By the half of the next year, there might appear real layoffs. explained Sorin Minea for Capital.ro.Economic Reports A range of primarily UK focused economic and business surveys are available. The Business Customer Economic Focus, which provides an overview of current macroeconomic and financial conditions and the impact on major industries, is usually produced three times a year. Financial market developments are reviewed on a more frequent basis, with the Interest & Exchange Rate Outlook being updated each month. Consequently, more regularly updated reports may contain interim forecasts and revisions made ahead of a full review of economic prospects.

Business Customer Economic FocusMay 2008

Economic backdropThe impact of the upheaval in international financial markets, which originated last summer in the US sub-prime mortgage market, has spread more widely. as conditions deteriorated further in the early months of this year, the backwash has been felt in most developed economies, particularly those with major financial centres. Growth prospects for the UK economy have been progressively downgraded, with a considerably below-trend pace of expansion now expected for both this year and 2009. This is a clear departure from the experience of 2006-07, when growth was running at a robust rate of around 3$. Tighter credit market conditions for households and businesses are likely to hold back both consumption and investment.

UK economic growth slowed to a below-trend annualised rate of 1.6$ in the first quarter of the year and could have lost further momentum during the spring. Survey evidence suggests that service sector activity outside of retailing is barely growing, with similar weakness being reported in the manufacturing sector and outright declines in construction. Official retail sales data have held up relatively well, but margins are coming under increasing pressure and trading updates from retailers suggest that a sharper slowdown lies ahead.

Profitability was strong as the corporate sector entered the current downswing, with non-oil trading profits growing by 10.2$ last year. Competitiveness has been helped by the sharp fall in sterling, but generating sales is likely to prove more difficult as the growth in international trade moderates from its recent strong pace. a weaker pound will also add to import costs, with sharply higher prices for fuel and agricultural products adding to margin pressure.O serie de studii focalizate , in primul rand, pe economia si afacerile din UK sunt disponibile. Revista .. care ne furnizeaza un punct de vedere despre curentul macroeconomic si conditiile financiare si impactul asupra industrilor mari este produs, de obicei, de 3 ori pe an. Evolutiile pietei financiare sunt analizate in mod frecvent in revista Dobanda si perspective ratei schimbului valutar care este actualizata in fiecare luna. In consecinta, rapoarte actualizate mai regulat ar putea contine estimari provizorii si cercetari facute inaintea unei intregi analize a conditiilor economice. Impactul prabusirii in pietele financiare internationale care a luat nastere vara trecuta in SUA in piata ipotecilor pt cei cu venituri mici, s-a raspandit extrem de mult, in situatia in care conditiile s-a deteriorat si mai mult in primele luni ale acestui an, agitatia a fost simtita in cele mai multe economii dezvoltate, in mod special in acelea cu centre financiare importante. Perspectivele de crestere pentru economia UK au luat-o pe o panta descendenta, cu un ritm de expansiune sub medie asteptat acum pentru anul acesta si pentru 2009. Este o indepartare clara de la experienta anilor 2006-07, cand cresterea avea un coeficient de 3 $. Conditiile mai dure ale pietei imprumuturilor pentru familii si persoane juridice probabil vor descuraja consumul si investitiile.Cresterea economica a Marii Britanii a incetinit la un coeficient annual de 1.6 $ in primul trimestru al acestui an si si-ar putea pierde avantul in timpul primaverii.Dovezile studiului sugereaza ca activitatea sectorului de servicii in afara retailul abia creste, o slabiciune similara fiind raportata si in sectorul industriei prelucratoare cu un declin categoric in constructii.Informatiile oficiale privitoare la vanzarile din domeniul retail s-au mentinut relativ bine, diferentele sunt supuse unor presiuni care cresc si actualizarile din comert de la retaileri sugereaza ca urmeaza o incetinire accentuata.Profitabilitatea a fost puternica pe masura ce sectorul corporatist intra in actualul downswing, cu profitul din comertul nepetrolier crescand pana la 10.2$ anul trecut.Competivitatea a fost ajutata de caderea valutei englezesti, dar a realiza vanzari s-ar putea sa se dovedeasca mai dificil pe masura ce cresterea comertului international se linisteste dupa ritmul puternic actual, o lira mai slaba va adauga costuri la import cu preturi mai mari pentru combustibil si produse agricole.

a se intensifica= toaggravate, toboost, tocompound, toenhance, toexaggerate, toincrease, tointensifya se confrunta=tocollate, toconfrontcareseconfruntcuodeciziegrea=betweenarockandhardplacedeflatie=deflationindice=coefficient, index[pl.: indices], indexnumber, indication, parameterpiata de consum= consumer marketdevastator=devastating, murderous, internecinepolitica monetara=monetary police

aacopericheltuielile=tomeetone'sexpensesa-iacopericheltuielile=topayone'swayajustificacheltuielile=toaccountforexpensesa combate=tocombat, toconfute, tocontrol, tofightacombaterceala=tofightoffacoldtomeetso.onhisownground=a combate pe cineva pe propriul sau terenanregistra= tobill, toregisteranregistra(contabil)= torecordanregistra(succese,unavantaj,etc.)[sport]=toscorecu toate acestea= actually, anyway, howbeit, however, neverthelessanalist economic=economic analystincertitudine= ambivalence, dubiety,incertitude, uncertaintyainepecinevanincertitudine= tokeepso.onthealertvolatilitate= evanescence, volatilityachiziie= acquisition, getting, job,

achiziiededate= dataacquisitionachiziiedeclieni= clientacquisitionbunuri de folosinta indelungata=hard-goods

totodata= concurrently, atthesametimedisponibilizari=layoffs

a disponibiliza=to lay off

lucru la negru=working under the table, unreported eployment

piata neagra= blackmarketRange= aliniament, amplitudine, anvergura, aranjament, band, btaie, categorie, clasa

Primarily= nprimulrnd, naintedetoate, iniial, la inceput

Overview= prezentaregeneral, privelite, privire de ansamblu, rezumat, vederedeansamblu, expunereReview= analiz, bilan, control, critic, cronica, jurnalperiodic[poligr.], priviregeneral, privireretrospectiv, recenzieto review=a analiza, acorecta, a fi cronic literar,a expune, afacecritic(literar), apovesti, a privi retrospectiv, a recenza

Outlook= concepie, perspectiv, perspective(deviitor), prevedere(astriitimpului), privelite, prognoza, punct de observatie, punctdevedereontheoutlook= lapnd, cu ochii in patru, deveghefocus= centru[fig.], centrulateniei[fig.], epicentru(alunuicutremur), focalizare, miez, primplan[fig.], punctcentral[fig.], sambure, centraretofocus(on)=a concentra ( gandurile, atentia), afocalizainterim= interimat, perioadinterimar, interimar, provizoriurevision= cercetare. control[metr., tehn.], revedere, revizie