Evaluarea Stocurilor19 IULIA JIANU

-

Upload

vlad-ciubotaru -

Category

Documents

-

view

256 -

download

0

Transcript of Evaluarea Stocurilor19 IULIA JIANU

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

1/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

180

EVALUAREA STOCURILOR NTREPRUDENI NONPRUDEN

Prof. univ. dr. Iulia JIANUAcademia de Studii Economice din Bucureti

Lect. univ. dr . Cristina VeneraGEAMBAU,Academia de Studii Economice

din BucuretiLect. univ. drd., Ionel JIANU,Universitatea

Titu Maiorescu din Bucureti

Rezumat:

Evaluarea n contabilitate reprezint procesulprin care se determin valoarea la careelementele situaiilor financiare suntrecunoscute n contabilitate i prezentate nbilani contul de profit i pierdere. Pornind dela importana evalurii n contabilitate, primulobiectiv de studiu al prezentei lucrri pune ncentrul discuiei evaluarea stocurilor n scopulidentificrii principalelor metode de evaluare a

stocurilor folosite de entitile economice cotatela Bursa de Valori EuroNext Paris. n contextul

actual n care criza financiarncse resimte lanivelul rilor din UE este important desemnalat n ce msurentitile economice daudovadde prudenn contabilitate prin luarean considerare a deprecierii stocurilor la databilanului. Respectarea principiului prudenei

pentru a integra incertitudinea n evaluareacontabilurmrete evitarea riscului de transfern perioadele viitoare a incertitudinilor prezente

susceptibile de a greva entitatea economic.Una din consecinele principale ale acestui

principiu este constituirea ajustrilor pentrudeprecierea stocurilor. Prin urmare cel de-aldoilea obiectiv al prezentei lucrri const nreflectarea msurii n care entitile supuse

studiului nregistreaz ajustri pentrudeprecierea stocurilor la data bilanului precumi n evidenierea modului de prezentare ainformaiilor privind modalitatea de calcul avalorii realizabile nete.

Cuvinte cheie: : IAS 2, stocuri, evaluarea

INVENTORIES MEASUREMENT BETWEEN PRUDENCE AND NON-

PRUDENCE

Prof. PhD, Iulia JIANU, BucharestAcademy of Economic Studies

Lecturer PhD, Cristina VeneraGEAMBAU,Bucharest Academy of

Economic StudiesLecturer PhD Student IonelJIANU,Bucharest Titu Maiorescu University

Abstract:

In accounting, measurement is the processused to determine the value at which theitems of financial statements are recognizedin accounting and presented in the balance

sheet and in the profit and loss account.Starting from the importance of measurementin accounting, the first study objective in this

paper brings in the center of discussion theinventories measurement with the purpose toidentify the main methods for inventoriesmeasurement at exit used by the economic

entities listed on EuroNext Paris ExchangeStock. In the present context, when thefinancial crisis is still felt in the EU countriesis important to note the extent to whicheconomic entities demonstrate prudence inaccounting by taking into consideration theinventories impairment at balance sheet date.Compliance with the prudence principle tointegrate uncertainty in accountingmeasurement has the purpose to avoid therisk to transfer in the future periods the

present uncertainties that are likely to strikethe economic entity. One of the mainconsequences of this principle is to makeimpairments for inventories. Therefore the

second objective of the present paper is toreflect the extent to which the entities under

study record impairments for inventories atbalance sheet date, as well as to highlight themanner in which is disclosed the informationregarding the way the net realizable valuecan be calculated.

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

2/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

181

stocurilor, pruden n contabilitate,deprecierea stocurilor, valoare realizabilnet

1. INTRODUCERE

Prezentul articol trateaz problematicaevalurii i prezentrii stocurilor n situaiilefinanciare. Motivul pentru care am ales casubiect de discuie stocurile rezidn importana

pe care acestea le au n activitatea entitiieconomice. Stocurile sunt importante deoarececuprind materiile prime i materialeleconsumabile, producia n curs de execuie,

produsele finite, elemente care ne transmitinformaii certe despre activitatea entitii. Sunt

poziiile din bilan care genereaz majoritateaveniturilor i cheltuielilor din contul de profit i

pierdere, unde ochiul vigilent al oricruiinvestitor caut amnuntele despre ceea ce sentmpl pentru a vedea dac sunt tranzacii idac valorile existente sunt mai mari sau maimici fa de cele de la nceputul exerciiuluifinanciar. Prin aceste elemente pulseaz viaaentitii deoarece reprezint suportul majoritiiactivitilor desfurate de entitile economice,contribuind de manier semnificativ la

obinerea profitului. i dac simpla trecere nrevista datelor din bilani contul de profit ipierdere ne ofer doar partea imagistic aradiografiei, o alta, respectiv notele la situaiilefinanciare ne ofer cheia de deschidere i

ptrundere a acestora. In note gsim, sau artrebui sgsim rspunsurile la ntrebrile legatede recunoaterea acestor categorii de active, demetoda de evaluare, de algoritmii sau judecilefolosite pentru determinarea valorii realizabilenete, despre metodele, principiile i preocuprile

care formeaz coninuturile politicilor contabileaplicate de entitatea economic n legtur custocurile. Afirmm aceasta deoarece nu mai este

posibil astzi s judecm corect performanaunei entiti economice pe baza situaiilorfinanciare dacnu stpnim n detaliu politicilecontabile ale entitii.

In ceea ce privete metodele de evaluare,sunt cunoscute, n funcie de momentul realizriievalurii: evaluarea la intrare (cost de achiziie,

de producie, respectiv valoare just), evaluarea

Key words:IAS 2, inventories measurement,prudence in accounting, inventoriesimpairment, net realizable value

1. INTRODUCTION

The present article discusses the issue ofinventories measurement and presentation inthe financial statements. The reason we havechoose as discussion subject the inventorieslies in their importance in economic entitysactivity. Inventories are important becausethey consist of raw materials, consumablematerials, work in progress, finished product,items that provide certain information aboutentitys activity. These are the balance sheetitems that generate most of the incomes andexpenses included in the profit and lossaccount where the vigilant eye of anyinvestor looks for details about what is goingon, if there are transactions and if the existentvalues are higher or lower than they were atthe beginning of accounting period. Throughthese items pulsates the life of the economicentity because they represent the support formost activities performed by economicentities, significantly contributing to income

obtaining. And if the simple review of datafrom the two financial situations previouslypresented offers us only the imagery ofradiography, another one, respectively thenotes to financial statements provide the keyto open and penetrate them. In notes we find,or we should find the answers to thequestions related to recognizing thesecategories of assets, to the evaluation method,to the algorithms or judgments made todetermine the recoverable net value, about

methods, principles and preoccupations thatconstitute the accounting policies applied bythe economic entity for inventories. Weaffirm this because today it is nolonger possible to judge correctly the

performance of an economic entity on thebasis of financial statements if we do notmaster in detail the entity's accounting

policies.Regarding measurement method,

there are known, according to the time of its

carrying out, beginning inventory valuation

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

3/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

182

la data bilanului (minimul dintre cost ivaloarea realizabil net) i la ieire (CMP,FIFO, LIFO). FIFO presupune recunoaterea pecheltuieli a celor mai vechi preuri n contul de

profit i pierdere. Aceast caracteristic estevzut adesea ca o deficien a metodei FIFO

deoarece costul curent de nlocuire a stocurilornu este corelat cu veniturile pe care le genereazaceste stocuri. Totui, n bilan, evaluareastocurilor prin metoda FIFO prezintstocurile lacele mai recente preuri i dacrata de rotaie astocurilor este suficient de rapid evaluarea

prin metoda FIFO va aproxima costul curent.DacCMP i FIFO sunt cunoscute i acceptatede standardele internaionale de raportarefinanciar, despre LIFO sunt necesare unele

precizri deoarece aceastmetodeste interzisn standardele IFRS. Astfel Se acceptideea cevaluarea stocurilor prin metoda LIFO este

preferat pentru calculul profitului deoarececostul bunurilor vndute are la baz, n general,costul curent al stocurilor. n schimb, metodelenon-LIFO sunt mult mai utile pentru evaluareastocurilor n bilan deoarece acestea sunt

prezentate la costul lor curent care reflect maibine capacitatea stocurilor de a genera fluxuriviitoare de numerar pentru entitate (Ross

Jennings& all, 1996).Pornind de la o realitate binecunoscut iacceptat de lumea contabil, respectiv

prezentarea informaiilor din situaiile financiarela cost, trebuie reafirmatnevoia de autentic, saumai bine zis, de real. Valoarea impus derealitatea pieei, diferit de cea oferit de cost,

pare a fi viitorul, existnd premise clare subforma anumitor elemente, deja prezentate lavaloare just n situaiile financiare. Susinereaacestei schimbri n problematica stocurilor

poate fi reprezentatprin urmtorul exemplu nmulte cazuri, stocurile n curs de execuiegenereazmari pierderi n procesul de producie,fr a fi luate ns n considerare. Manageriitrebuie scunoascvaloarea de piaa stocurilorn curs de execuie deoarece ei sunt cei care iaudecizii la nivelul ntregii organizaii (Lloyd JTaylor & al., 2004). Buletinul de cercetri itehnologii contabile (1961) definete principiulcostului astfel costul principal sau costulrezidual care are ntotdeauna cea mai mic

valoare. Dac utilitatea bunului, reprezentat

(acquisition cost, production cost,respectively fair value), inventory valuationat balance sheet date (cost, net realizablevalue) and ending inventory valuation (WAC,FIFO or, why not, LIFO). FIFO charges theoldest costs against revenues on the income

statements. This characteristic is oftenviewed as a deficiency of the FIFO method,since the current cost of replacing the unitssold is not being matched with currentrevenues. However, on the balance sheet,FIFO inventory represents the most recent

purchases and if inventory turnover isreasonably rapid will usually approximatecurrent replacement cost. If WAC and FIFOare known and accepted by internationalstandards, some clarifications are needed onLIFO. So, It is often argued that LIFOincome statements are more useful as a basisfor valuation than those prepared underalternative cost-flow assumptions (such asFIFO or average cost) because LIFO cost ofgoods sold is based on relatively currentinventory costs. In contrast, non-LIFO

balance sheets are alleged to be more usefulfor measurement because their inventoryvalues, also based on relatively current costs,

better represent the net assets available togenerate future resource inflows (Jennings etal, 1996).

Starting from a fact that is known andaccepted by the accounting world,respectively the disclosure of information offinancial statements at cost, it must bereaffirmed the need for authentic or better sayfor real. The value imposed by the marketreality, different from the one provided by

cost, seems to be the future, existing clearpremises under the form of certain item thatare already presented at fair value in thefinancial statements. Supporting this changein inventory problem is given by As anexample, in many instances, work in process(WIP) inventory actually loses real worldvalue if it goes through the manufacturing

process, and this loss of value is notconsidered on the financial statements.Managers need to know the market value of

WIP inventory as it goes through the

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

4/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

183

prin vnzarea n cursul normal al afacerilor va fimai mic dect costul, indiferent dac estedatorat de deprecierea fizic, schimbriletehnologice care influeneaz preurile sau dinalte cauze, diferena trebuie sfie recunoscutcao pierdere n perioada curent.

Referitor la acest aspect trebuieexemplificat prin ceea ce prevede IAS 2principala baza de evaluare a stocurilor estecostul, care n general este definit ca preul pltit

pentru a achiziiona un activ. Adaptat la stocuri,costul reprezintsuma aferentcheltuielilor saucosturilor directe sau indirecte aprute n

procesul de producie a unui bun (IASB, 2009).IAS 2 cere ca stocurile s fie evaluate la data

bilanului la minimul dintre cost i valoarearealizabil net. Valoarea realizabil net este

preul de vnzare estimat ce ar putea fi obinutpe parcursul desfurrii normale a activitii,mai puin costurile estimate pentru finalizarea

bunului i a costurilor necesare vnzrii.Estimarea valorii realizabile nete ia nconsiderare fluctuaiile de pre i de cost caresunt direct legate de evenimente ce au intervenitdup terminarea perioadei, n msura n careaceste evenimente confirm condiiile existentela sfritul perioadei. Valoarea realizabil net

se determin la sfritul fiecrui exerciiufinanciar. IAS 2 precizeaz: Dacacele condiiicare au determinat decizia de a diminua valoareastocului pn la valoarea realizabil net auncetat s mai existe, valoarea de intrare estestornat (stornarea fiind limitat la valoareanregistrrii originale), astfel nct noua valoarecontabila stocului sfie egalcu cea mai micvaloare dintre valoarea de intrare i valoarearealizabil net revizuit. Aceasta se ntmpl,de exemplu, cnd un produs din stoc, care este

nregistrat la valoarea realizabilnet, este ncn stoc ntr-o perioad ulterioar, iar preul sude vnzare crete.

Toate elementele prezentate anterior,transformate n cerine de performan nlegtur cu conturile de stocuri, conduc lafiabilitate informaional, respectiv lainformarea corect a destinatarilor. n acestscop, n prezentul articol ne-am propus srealizm o analiz cantitativ i calitativ amodului n care entitile economice care aplic

IFRS prezint n notele la situaiile financiare

manufacturing process because only then willmanagers be able to make knowledgeabledecisions that affect the goal of theirorganization (Taylor et al).

This aspect should be exemplified bywhat provides IAS 2 the primary basis of

accounting for inventories is cost, which hasbeen defined generally as the price paid orconsideration given to acquire an asset. Asapplied to inventories, cost means the sum ofthe applicable expenditures and chargesdirectly or indirectly incurred in bringing anarticle to its existing condition and location.(IASB, 2009). The Accounting Research andTerminology Buletin describes the principalof cost or residual useful cost, which ever islower, as follows: When is evidence that theutility of goods, in their disposal in theordinary course of business will be less thancost, whether due to physical deterioration,obsolesce changes in price levels, or othercauses, the difference should be recognizedas a loss of the current period.

All the elements previously presented,transformed in performance requirementsregarding the inventory accounts, lead toinformational reliability, respectively to the

correct information of recipients. In thispurpose, in this article we intend to perform aquantitative and qualitative analysis of howeconomic entities that apply IFRS disclose inthe notes to financial statements the methodsused to measure inventories and the way todetermine the net realizable value. Coverageof the valuation methods and the impairmentof stocks in the notes to financial statementsare perceived differently in terms of theirimportance. Although IFRS require the

disclosure, in the notes to financialstatements, of the inventory measurementmethods and of the manner the net realizablevalue is determined, few companies aremeeting this imperative.

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

5/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

184

metodele folosite pentru evaluarea stocurilor imodul de determinare a valorii realizabile nete.Reflectarea metodelor de evaluare i a celor dedepreciere a stocurilor n notele la situaiilefinanciare sunt percepute diferit de utilizatoriiinformaiei contabile n funcie de importanei

lor. Cu toate c IFRS prevd obligativitateaprezentrii n notele la situaiile financiare ametodelor de evaluare a stocurilor i a moduluide determinare a valorii realizabile nete, puinesunt firmele care respectacest imperativ.2. METODOLOGIA CERCETRII

Scopul cercetrii noastre este de ademonstra, din perspectiva practicii, importanareflectrii n situaiile financiare anuale atratamentelor, a metodelor de evaluare i a

politicilor contabile aplicabile n cazulstocurilor. Obiectivele temei de cercetare suntorientate spre evidenierea modului n careentitile economice care aplic IFRS respectcerinele de prezentare a informaiilor privindmetodele de evaluare i de depreciere astocurilor n cadrul notelor la situaiilefinanciare.

Cu scopul declarat de a surprindeconformitatea cu IFRS, vom aborda o cercetarede tip empiric pentru a verifica urmtoarele

ipoteze:I1: Entitile economice care aplic IFRS

prezint n notele la situaiile financiareinformaii privind politicile contabile folosite laevaluarea stocurilor, inclusiv formulele folosite

pentru determinarea costului conform art. 36, pct(a), IAS 2.

I2: Entitile economice care aplic IFRSprezint n notele la informaiile financiare

valoarea oricrei diminuri a valorii stocurilorrecunoscutdrept cheltuialn cursul perioadei,conform art.36, pct (e), IAS 2 i prezentareainformaiilor privind modalitatea de calcul avalorii realizabile nete.

Pentru verificarea ipotezelor de cercetaream procedat la o cercetare de tip empiric princulegerea datelor din cadrul rapoartelor anuale

publicate de entitile cotate la Bursa EuronextParis pe site-ul www.orderannualreports.com.Eantionul analizat, format din cele 18 societi

cotate care i-au depus rapoartele anuale pe site-

2. RESEARCH METHODOLOGY

The aim of our research is to demonstrate, interms of practice, the importance of reflectingin the annual financial statements of thetreatments, the measurement methods and the

accounting policies applicable to inventories.The objectives of the research theme arefocused on highlighting how economicentities that apply IFRS comply therequirement for disclosure of informationregarding the methods for inventorymeasurement and impairment in the notes tofinancial statements.

With the stated purpose of capturingcompliance with IFRS, we will approach anempirical research to verify the followinghypotheses:

H1: Economic entities applying IFRSdisclose in the notes to financial statementsinformation regarding the accounting policiesused to measure inventories, including theformulas used to determine the costaccording to art. 36, point (a), IAS 2.

H2: Economic entities applying IFRSdisclose in the notes to financial statementsthe value of any decrease of inventories valuerecognized as expense during the period,according to art.36, point (e), IAS 2 and alsodisclose information of how the net realizablevalue is calculated.

To verify the research hypotheses wecollected data from the annual reports

published by the entities listed on EuroNext

Paris Exchange Stock on the sitewww.orderannualreports.com. The analyzedsample, formed by the 18 listed companiesthat published the annual reports on the sitementioned above provided us an image ofwhat financial reporting and annual reportmean, that can be anytime an example forRomanian entities. Searching and trying tocatch only the information specific to the

purpose and objectives of this study, welimited the final analysis to the data collected

from 11 economic entities presented inAnnex

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

6/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

185

ul menionat mai sus ne-a oferit o imagineampl asupra a ceea ce nseamn raportarefinanciar, raport anual, putndu-se constituioricnd n model i pentru entitile romneti.Cutnd i ncercnd s surprindem doar aceleinformaii specifice scopului i obiectivelor

prezentului studiu, am restrns analiza finalasupra datelor culese de la 11 entiti economice

prezentate n Anexa 1, situaia celor 7 entitieliminate prezentndu-se dupcum urmeaz:

5 dintre acestea nu prezint situaiifinanciare detaliate n raportul anual;2 dintre acestea nu prezint n cadrulbilanului poziia stocuri.

3. REZULTATE I DISCUIIEste dificil s purtm o discuie despre

stocuri, chiar i ntre profesioniti, fra avea oscurt informare despre ceea ce reprezintacestea i ce se ntmplcu ele n contabilitateaentitii economice. i dac avem n vedereobiectul de activitate al entitilor economice,discuia poate duce la unele dezacorduri cu

privire la nivelurile de percepie i reprezentareale interlocutorilor. De aceea, o lmurire a

lucrurilor se impune la acest moment. Unangrosist sau comerciant cu amnuntul cumpractive cum ar fi cri care sunt imediat vandabilen forma lor actual. Activele deinute pentruvnzare sunt numite stocuri. n aceast situaia,un angrosist sau un comerciant va avea n bilanun singur cont de stocuri denumit marf. nschimb, o societate de producie care va obine

produse, de exemplu autoturisme, utilizeazmaimulte conturi pentru evidena stocurilor, precumstocurile de materii prime, producie n curs de

execuie, produse finite. n acest sens IAS 2folosete termenul de stoc pentru a reprezentaelementele tangibile care: sunt deinute pentruvnzarea n cursul normal al afacerilor, sunt ncurs de producie n scopul vnzrii, se consumn procesul de producie pentru obinerea de

bunuri sau servicii disponibile pentru vnzare.Din definiia mai sus prezentat este clar cntlnirea, dar mai ales prezena stocurilor se

produce, respectiv este prezent, n i la toatefunciile entitii: aprovizionare, producie,

desfacere n mod direct; financiar-contabil,

1, the situation of the 7 eliminated entitiesbeing the following:

5 of them do not disclose detailedfinancial statements in the annualreport;2 of them do not disclose theinventory item in the balance sheet.

3. RESULTS AND DISCUSSIONS

It is difficult to have a discussion aboutinventories, even among professionals,without a brief information about what arethey and what happens to them in theaccounts of the economic entity. And if we

consider the activity objective of economicentities, the discussion can lead to somedisagreement on the levels of perception andrepresentation of other speakers. Therefore,an explanation of things is necessary at thistime. A wholesaler or retailer buys assets like

books that are immediately saleable in theircurrent form. Assets held for sale are calledinventories. A typical wholesaler or retailerwill have only one inventory account, calledmerchandise inventory, on its balance sheet.

A manufacturing firm making a final productlike cars uses inputs from many differentsuppliers. Consequently, manufacturers

balance sheets typically include threecategories of inventory accounts: rawmaterial inventory, work in process inventoryand finished goods inventory. IAS 2 goes tostate the term inventory is used to designatethose items of tangible assets which:

Are held for sale in the ordinarycourse of business;

Are in process of production for suchsale;Are to be currently consumed in theproduction of goods or services to beavailable for sale.

From the definition presented above it is clearthat meeting, but especially the presence ofinventory produces, respectively is present, inand at all entity functions: purchasing,

production, sales directly; financial-accounting, research - development and

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

7/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

186

cercetare- dezvoltare i resurse umane n modindirect. ncercarea de demonstrare a celor douipoteze de lucru va comporta att o analizcantitativct i o analizcalitativ.

Pentru a reflecta mrimea stocurilor la nivelul

entitilor analizate am considerat oportun oprezentare n Tabelul 1 a soldurilor finale alestocurilor din bilan, precum i pondereaacestora n activele circulante i n totalulactivelor entitilor economice.

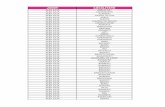

Tabel 1.Ponderea valorii stocurilor n totalulactivelor circulante, respectiv n totalul activului(mii euro)

Situaia prezentateste sugestiv, contribuind laconturarea ideii cponderea acestor active estefoarte mic, ceea ce demonstreaz eficienaentitii. Este firesc ca la sfrit de an savemvalori mici la aceastcategorie de active, acesteafcnd obiectul tranzaciilor aductoare devenituri. n general, stocurile reprezintun activsemnificativ, att n mrime absolut ct i

procentual n valoarea total a activelorentitii. Mai mult, vnzarea stocurilor la un presuperior costului reprezint principala surs de

sustenabilitate a entitii. Din acest motiv,contabilitatea stocurilor este extrem deimportant.4. DEMONSTRAREA PRIMEI IPOTEZEI1: Entitile economice care aplic IFRS

prezint n notele la situaiile financiareinformaii privind politicile contabile folosite laevaluarea stocurilor, inclusiv formulele folosite

pentru detrminarea costului conform art. 36, pct(a), IAS 2.4.1. ANALIZA CANTITATIV

Prin analiza informaiilor prezentate de entitilesupuse studiului n cadrul notelor la situaiilefinanciare referitor la metodele de evaluare astocurilor, am putut constata c zece entiti

prezintn note politicile contabile referitoare laevaluarea stocurilor, n timp ce o singurentitatenu prezint nici un fel de informaie privindevaluarea stocurilor n notele la situaiilefinanciare. Referitor la formulele de calcul acostului, situaia este echilibrat, n sensul ccinci entiti economice prezint informaii

privind formulele de calcul, ns ntr-o manier

human resources - indirectly. The intent todemonstrate the two work hypotheses willinvolve both quantitative and qualitativeanalysis.

To reflect the size of inventories at thelevel of analyzed entities we considered as

being opportune a presentation, in Annex 2,of the final balances of inventory in the

balance sheet at the ending of financialperiod, as well as their share in the currentassets and in the total assets of economicentities. The situation presented is suggestive,contributing to the idea that the share of theseassets is very low, which demonstrates theeffectiveness of the entity. It is natural that atthe end of the year to have little value to thisasset class, these being the object oftransactions that bring incomes. Inventoriesare usually a significant asset, both inabsolute size and in proportion to all of acompanys other assets. Furthermore, sellinginventories for a price greater than their costrepresents the main source of firmssustainable income. For these reasons,inventory accounting is exceedinglyimportant.

4. DEMONSTRATION OF THE FIRSTHYPOTHESIS

H1: Economic entities applying IFRSdisclose in the notes to financial statementsinformation regarding the accounting policiesused to measure inventories, including theformulas used to determine the costaccording to art. 36, point (a), IAS 2.

4.1. QUANTITATIVE ANALYSIS

By analyzing the informationsubmitted by the entities under study in thenotes to the financial statements on inventorymeasurement methods, we could observe that10 entities present in the notes the accounting

policies on inventory measurement, while asingle entity does not have any informationon inventory measurement in the notes tofinancial statements. Regarding the cost

formulas, the situation is balanced, meaning

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

8/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

187

destul de simplist, n timp ce ase entitieconomice nu prezint niciun fel de informaiereferitoare la modul de calcul al costului.

Grafic 1.Politici contabile de evaluare astocurilori formule de calcul al costului

stocurilor

n Tabelul 2(la finalul lucrari) sunt prezentateinformaiile privind metodele de evaluare i decalcul al costului oferite de entitile analizate nnotele lor la situaiile financiare.

4.2. ANALIZA CALITATIV

Cu privire la politicile contabile privindevaluarea, dei ponderea celor care fac referirela subiectul n cauz este foarte mare, trebuiespus cacestea nu sunt elocvente, nu prezintn

detaliu ce doresc s guverneze, nu esteprezentatmaniera de lucru, ceea ce ne face scredem c acestea sunt trecute doar ca oconcesie la adresa reglementrilor internaionale.Referirile la metodele de alocare a costurilorntre stocurile finale i costul bunurilor vndute,de altfel una dintre cele mai delicate subiecte cein de contabilitatea stocurilor, sunt la fel de

puin discutate, deloc problematizate i doartrecute n revist. De asemenea nu gsim nnotele la situaiile financiare informaii cu

privire la determinarea cantitilor de stocuri,

that 5 economic entities provide informationon formulas, but in a rather simplisticmanner, while 6 economic entities do nothave any information on how cost iscalculated.

Table 1. Accounting policies of themeasurement inventories

Table 2.Formulas of inventories costcalculation

In Annex 3 is presented information onmeasurement methods and cost calculation ofthe inventories provided by the studiedentities in their notes to financial statements.

4.2. QUALITATIVE ANALYSIS

Regarding the accounting policies for

measurement, although the percentage ofpeople who refer to the subject matter is veryhigh, it must be said that they are noteloquent, not detailing what they want togovern, it is not presented the manner ofworking, which makes us think that they arelisted only as a concession to the internationalregulations. References to the methods ofcost allocation between final inventories andthe cost of goods sold, in fact one of the mostsensitive issues related to inventory

accounting, are also little discussed and justreviewed. Also we find in the notes to

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

9/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

188

sau mai concret spus referiri la cele doumetodeposibile: inventarul permanent, respectivinventarul intermitent. Maniera sintetic de

prezentare a politicilor contabile referitoare laevaluare i la formulele de calcul al costului nucorespunde nivelurilor impuse de IAS 2 motiv

pentru care considerm ca invalidat primaipotezde cercetare.

5. DEMONSTRAREA CELEI DE-A DOUAIPOTEZE

I2: Entitile economice care aplic IFRSprezint n notele la informaiile financiarevaloarea oricrei diminuri a valorii stocurilorrecunoscutdrept cheltuialn cursul perioadei,conform art.36, pct (e), IAS 2 i prezentareainformaiilor privind modalitatea de calcul avalorii realizabile nete.

5.1. ANALIZA CANTITATIV

Prin analiza informaiilor prezentate de entitilesupuse studiului n cadrul notelor la situaiilefinanciare privind valoarea deprecierii stocurilori modalitatea de calcul a valorii realizabile nete(VRN) am putut constata c doar patru entiti

i fac cunoscute inteniile, dou entiti ofervalori ale deprecierii efective, iar cinci entitinu iau n discuie acest aspect. n ceea ce

privete modalitatea de calcul a VRN doar patruentitile economice prezint astfel deinformaii.

Grafic 2.Prezentarea de informaii n notele lasituaiile financiare privind deprecierea

stocurilori modul de calcul al VRN

financial information on determining thequantities of inventories, or more specificallysaid referring to the two possible methods for

permanent inventory, respectively periodicinventory. Taking into account the two issuesaddressed the synthetic manner of presenting

the accounting policies relating to inventoriesmeasurement and cost formulas do notcorrespond to the levels required by IAS 2reason to consider the first researchhypothesis as invalidated.

5. DEMONSTRATION OF THESECOND HYPOTHESIS

H2: Economic entities applying IFRSdisclose in the notes to financial statementsthe value of any decrease of inventories valuerecognized as expense during the period,according to art.36, point (e), IAS 2 and alsodisclose information of how the net realizablevalue is calculated.

5.1. QUANTITATIVE ANALYSIS

By analyzing the information submitted by

the entities under study in the notes to thefinancial statements on the value ofinventories impairment and on the method ofcalculating the net realizable value (NRV) wenoticed that only 4 entities make known theirintentions, 2 entities provide the actual valueof impairment and 5 entities do not considerthis issue. Regarding the method forcalculating the NRV only four economicentities disclose such information.

Table 3.Disclosure of the impairment

inventoriesTable 4.Disclosure of the VRN cost

calculation

36%

18%

46%

descriptivdisclosuremonetarydisclosurenondisclosure

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

10/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

189

Situaia din Tabelul 3este sugestivpentru ceeace nseamn practica ajustrilor pentrudeprecierea stocurilor folosite de entitileanalizate iar Tabelul 4 pentru a arta modul ncare entitile analizate prezent informaii

privind modalitatea de calcul a VRN.

5.2. ANALIZA CALITATIV

Valoarea oricrei diminuri a valorii stocurilorpn la valoarea realizabil net i toatepierderile de stocuri vor fi recunoscute dreptcheltuialn perioada n care are loc diminuareasau pierderea (IAS 2 Stocuri). Conform IAS 2,stocurile trebuie evaluate la valoarea cea maimic dintre cost i valoarea realizabil net.Dac discuia despre costuri este rezolvat

aproape total de valorile nscrise n documentelecare nsoesc achiziia, producia i intrarea nposesie de elemente de stocuri, nu acelai lucruse poate spune i despre valoarea realizabilnet. Estimarea valorii realizabile nete se

bazeaz pe cele mai credibile dovezi nmomentul n care are loc estimarea valoriistocurilor care se ateaptsfie realizat. Acesteestimri iau n considerare fluctuaiile de preide cost care sunt direct legate de evenimente ceau intervenit dup terminarea perioadei. Un alt

element demn de luat n considerare ar fi iscopul pentru care stocurile sunt deinute. Suntdoar cteva dintre reglementrile ce legifereazntr-un fel practicile n domeniul stocurilor.Pornind de la acestea, este lesne de vzut cinformaiile pe care am reuit sle culegem suntsumar prezentate, cnu urmeazlinia trasatdeIAS 2 i c nu duc la o informare complet ainvestitorilor, ceea ce ne determinscredem c

pentru managerii i acionarii acestor entiti,stocurile nu reprezinto prioritate, motiv pentru

care putem afirma ci cea de-a doua ipoteza

The situation in Annex 4 is suggestive forwhat the practice of adjustments means forinventory impairment and the Annex 5 toshow how the analyzed entities provideinformation concerning the calculation of the

NRV.5.2. QUALITATIVE ANALYSIS

The amount of any reduction in value ofinventories to net realizable value and alllosses of inventories should be recognized asan expense in the period in which thereduction or loss take place. Under IAS 2,inventories should be valued at the lowervalue of cost and net realizable value. If thediscussion of costs is almost completelyresolved by the values registered in thedocuments accompanying the acquisition,

production and possession of inventory items,

the same can be said about the net realizablevalue. The estimation of net realizable valueis based on the most credible evidence thatoccurs when estimating the value ofinventories that are expected to be achieved.These estimates take into account fluctuationsin price or cost directly related to eventsoccurring after the end of the period. Anotherelement worthy of consideration would be the

purpose for which inventories are held. Theseare only a few of the regulations that legislate

in a way the practices in the inventories field.On this basis, it is easy to see that theinformation we were able to collect are

briefly presented, that do not follow the linedrawn by IAS 2 and that do not lead to acomplete information of investors whichleads us to believe that for the managers andshareholders of these entities the inventoriesare not a priority. Taking into account thesynthetic manner of presenting theinformation relating to inventories NRV andits cost formulas we can say that the second

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

11/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

190

prezentului studiu este invalidat.

6. CONCLUZIINevalidarea ipotezelor noastre nu trebuie

privit ca un eec al demersului tiinific, ci ca

valoare adugat, datorit semnalrii unordisfuncionalitti, unor puncte prea puindezvoltate n practica raportrii financiare lanivelul entitilor a cror contabilitate este unconglomerat de norme naionale, europene iinternaionale. Oricte eforturi s-ar face pe linia

pstrrii nealterate a uneia sau a alteia dintreabordri, gsim dificil pstrarea acestei distanei faptul ca informaia sntruneascstandardelede calitate impuse de realitatea economic icerute de utilizatori. Rmne un adevr faptulreferitor la copilul cu multe moae rmnenemoit. Trebuie s credem, n lips de alteargumente, n faptul cdoar aplicarea conformcu IFRS-urile ne asiguro prezentare detaliat,complet i ndestultoare a informaieifinanciare pentru utilizatorii si. O entitate nu va

putea descrie situaiile financiare ca fiindconforme cu IFRS-urile, dect dac acesteasatisfac toate dispoziiile IFRS-urile (art 16, IAS1).

O alt explicaie ar pute-o constitui lipsa deexigen, ca s nu spunem dezinteresul celorcare guverneaz destinele entitilor economicefade problematica stocurilor, un capitol care laacest moment poate fi uor trecut n plan secund.Acest lucru este susinut i de lipsa de prudenn evaluarea stocurilor pentru mai mult de 50%din entitile analizate. Este posibil acest lucruatta timp ct afacerea merge, atta timp ct ceeace se cumpr se vinde, dar cum vor reaciona

toi acetia n momentul cnd vor fi blocaje,cnd marfa sau produsul finit vor umple pnlarefuz spaiile de depozitare, se vor deprecia fizic,uza moral. S fie oare prea trziu? Sperm cnu, iar prin lucrarea de fa lansm invitaia lareflecie, la conformitate, la aciune. Este i unnceput de drum pentru alte studii i cercetriulterioare, deoarece stabilirea unei baze deevaluare care s rspund tuturorcondiionalitilor de mediu (social, economic,uman i chiar politic) este dificil de stabilit n

materia stocurilor i nu numai.

hypothesis of this study is also invalidated.

6. CONCLUSIONS

The invalidation of our hypotheses should not

be regarded as a failure of the scientificapproach, but as an added value due tomalfunction alert, to some points that arelittle developed in the practice of financialreporting at the level of the entities whoseaccounting is a conglomeration of national,European and international rules. No matterhow many efforts are made to preserveunspoiled one or another of the approaches,we find difficult to keep this distance and thefact that the information should meet thequality standards required by the economicreality and users. We must believe, in theabsence of other arguments that onlyconsistent application of IFRS provides uswith a detailed, complete and plentiful

presentation of financial information to itsusers. An entity can not describe the financialstatements as complying with IFRSs unlessthey meet all the provisions of IFRS (Article16, IAS 1).

Another explanation could be the lack ofexigency, not to say the indifference of thosewho govern the destinies of economic entitiesto the issue of inventory, a chapter that at thistime can easily be overshadowed. This issupported by the lack of prudence inmeasurement inventories for more than 50%of the examined entities. This is possible aslong as the business goes, as long as what is

bought is sold, but how will they react when

there will be bottoming, when the goods orthe finished product will fill up storage areas,will physically depreciate, moral wear. Is ittoo late? Lets hope not, and through this

paper we launch the invitation to reflection,to compliance, to action. It is also the

beginning of the road for further studies andfurther research, because to establish ameasurement base that meets all benchmarksof environmental (social, economic, humanand even political) is difficult to determine in

relation to inventories and not only.

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

12/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

191

Tabel 1.Ponderea valorii stocurilor n totalul activelor circulante, respectiv n totalul activului (mii euro)

Ponderea stocurilor inNumele entitii Valoare stocuri Valoare activecirculante

Valoare totalaactive Active

circulanteTotal active

AFFINE 20.520.000 206.683.000 1.282.304.000 9,92% 1,60%BIC 300.973 1.208.529 2.029,122 24,90% 14,83%CEGEDIM 483 111.568 1.026.055 0,43% 0,047%CHRISTIAN 5.802 11.311 36.053 51,29% 19,09%

Maniera simplistde a prezenta i proba anumiteaspecte ce in de susinerea i promovarea

propriei afaceri, pe termen lung, considerm noi,poate avea consecine dintre cele mai grave.Dacne vom prevala de lipsa de informaie, de

mesaj tehnic, (de prezentare efectiv a unormetode, modele i formule de calcul) anormativelor i reglementrilor din domeniu,dacnu vom ncerca spropunem i saducemn discuie propriile viziuni, atunci raionamentul

profesionistului contabil ar deveni o noiuneperimat.

MULTUMIRI

Aceast lucrare este finanat de CNCSIS-UEFISCDI, prin proiectul numrul PN II-RU326/2010 Dezvoltarea i implementarea lanivelul entitilor din Romnia a unui model deevaluare bazat pe conceptual menineriicapitalului fizic.

REFERINTE BIBLIOGRAFICE

IASB (2009) International Financial Reporting

Standards, Ed. CECCARJennings R., Simko P.J. and Thompson R,B(1996) Does LIFO Inventory AccountingImprove the Income Statement at the Expenseof the Balance Sheet?, Journal of

Accounting Research, Vol. 34, No. 1Taylor L.J III, Nunley A.M. III; Flock M.D

(2004) WIP Inventory: Asset or Liability?Cost Engineering,Vol.46, No.8

Accounting Research and Terminology Bulletins Final Edition (1961), New York, American

Institute of Certified Public Accounts, pp. 30- 31

The simplistic way to present and test certainaspects of their business support and

promote, on the long term, we believe, canhave most serious consequences. If we relyon the lack of information, of technical

message (the effective presentation ofmethods, models and formulas) of norms andregulations in the field, if we do not try to

propose and bring into question our ownviews, then the reasoning of professionalaccountant would become outdated notion.

ACKNOWLEDGEMENTS

This work was supported by CNCSIS-UEFISCSU, project number 14 PN II-RU326/2010 The development andimplementation at the level of economicentities from Romania of a evaluation modelbased on physical capital maintenanceconcept

REFERENCES

IASB (2009) International FinancialReporting Standards, Ed. CECCAR

Jennings R., Simko P.J. and Thompson R,B(1996)Does LIFO Inventory AccountingImprove the Income Statement at theExpense of the Balance Sheet?, Journalof Accounting Research, Vol. 34, No. 1

Taylor L.J III, Nunley A.M. III; Flock M.D(2004) WIP Inventory: Asset orLiability? Cost Engineering, Vol.46,

No.8Accounting Research and TerminologyBulletins Final Edition (1961), New York,

American Institute of Certified PublicAccounts, pp. 30 - 31

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

13/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

192

DIOREXELINDUSTRIES

94.790 236.916 326.759 40% 29%

FONCIERE DEREGION

117.307 665.008 13.952.606 17,63% 0,84%

PUBLICIS 290.000 7.293.000 12.730.000 3,97% 2,27%REXEL 1.141.400 3.816.900 9.054.900 29,90% 12,60%TECHNIP 215,4 4660,2 8570 4,62% 2,51%VINCI 755.700 18.474.800 52.436.100 4,09% 1,44%VIVENDI 777 12 342 58 125 6,3% 13,36%

Tabel 2. Prezentrile de informaii privind metodele de evaluare a stocurilori formulele de calcul a costuluistocurilor la entitile economice supuse studiului

Numele entitii Metode de evaluareAFFINE Nu prezintinformaiiBIC Stocurile sunt nregistrate la cea mai mic valoare dintre cost i valoarea realizabil net.

Costul include materialele directe i, dac este cazul, costurile forei de munc directe icheltuielile care au fost suportate pentru a aduce stocurile la locul i starea lor actual. Costuleste calculat folosind metoda costului mediu ponderat.

CEGEDIM Stocurile sunt evaluate prin metoda costului mediu ponderat. Valoarea de intrare a stocurilorinclude preul de cumprare i cheltuielile accesorii.CHRISTIAN DIOR Vinul produs de grup, n special ampania, este evaluat la valoarea de piaa recoltei, ca i

cnd strugurii recoltai ar fi fost achiziionai de la teri. Pn la data de recoltare, valoareastrugurilor este calculat pro rata temporis n funcie de randament estimat i valoarea depia. Stocurile sunt evaluate pe baza costului mediu ponderat sau a metodei FIFO.

EXEL INDUSTRIES Stocurile sunt evaluate la cea mai mic valoare dintre cost i valoarea realizabil net. Sefolosete metoda FIFO.

FONCIERE DE REGION Stocurile sunt nregistrate la costul de achiziie i sunt supuse deprecierii pnla limita valoriirealizabile nete.

PUBLICIS Stocurile sunt nregistrate la nivelur costurilor suportate i o depreciere este nregistratatuncicnd valoarea lor realizabilneteste mai micdect costul.

REXEL Stocurile sunt evaluate la cea mai micvaloare dintre cost i valoarea realizabilnet. Costuleste calculat prin metoda FIFO, include cheltuielile de transport i exclude orice reducere

primit.TECHNIP Stocurile sunt recunoscute la cea mai micvaloare dintre cost i valoarea de pia, costul fiindcalculat prin metoda costului mediu ponderat.

VINCI Stocurile sunt recunoscute la costul de achiziie sau de producie. La fiecare data bilanuluiele sunt evaluate la cea mai micvaloare dintre cost i valoarea realizabilnet.

VIVENDI Stocurile sunt evaluate la cea mai micvaloare dintre cost i valoarea realizabilnet. costulcuprinde costurile de achiziie, costurile de producie i alte costuri de aprovizionare. Costuleste n general calculat prin metoda costului mediu ponderat.

Tabel 3. Valoarea ajustrilor pentru deprecierea stocurilor i informaiile descriptive privind deprecierea stocurilorprezentate de entitile economice supuse studiului n notele la situaiile financiare

Numele entitii AJUSTRI PENTRU DEPRECIERIAFFINE 1.843 mil. euro

BIC 24.643 mil. euroCEGEDIM Deprecierea este nregistratdacvaloarea contabileste mai micdect valoarea de

inventar (valoarea realizabilnet).CHRISTIAN DIOR Deprecierea este nregistrat pentru toate stocurile cu excepia vinurilor i buturilor

spirtoase. Deprecierea apare datorit uzurii morale a stocurilor sau lipsei deperspectiva vnzrilor.

EXEL INDUSTRIES Nu prezintinformaiiFONCIERE DE REGION Nu prezintinformaiiPUBLICIS O depreciere este nregistratcnd valoarea realizabilneteste mai micdect costul.REXEL Nu prezintinformaiiTECHNIP Deprecierea este nregistratcnd valoarea realizabilneta stocurilor este mai mic

dect valoarea lor realizabilnet.VINCI Nu prezintinformaiiVIVENDI Nu prezintinformaii

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

14/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

193

Tabel 4.Informaii despre modalitatea de calcul a VRN prezentate de entitile economice supuse studiului n notelela situaiile financiare

Numele entitiiPrezentri de informaii n notele la situaiile financiare cu privire la modalitatea

de calcul a VRNAFFINE Nu prezintinformaiiBIC VRN reprezint preul de vnzare estimat mai puin orice costuri estimate pentru

finalizarea produciei i orice costuri aprute din activitatea de marketing, vnzare saudistribuire a produselor.CEGEDIM Nu prezintinformaiiCHRISTIAN DIOR Nu prezintinformaiiEXEL INDUSTRIES VRN reprezint preul de vnzare estimat n condiii normale de afaceri, mai puin

cheltuielile cu vnzareaFONCIERE DE REGION Nu prezintinformaiiPUBLICIS n scopul stabilirii valorii realizabile nete, stocurile i costurile facturabile clienilor

sunt revizuite de la caz la caz pe baza unor criterii, cum ar fi existen a litigiilor cuclienii.

REXEL Valoarea realizabil net este preul de vnzare estimat la data bilanului, mai puincheltuielile estimate de vnzare, lund n considerare uzura moral tehnic saucomerciali riscurile legate de micarea lenta stocurilor.

TECHNIP Nu prezintinformaii

VINCI Nu prezintinformaiiVIVENDI Nu prezintinformaii

ANEXA 1Prezentarea entitilor economice supuse studiului

Nr. Numele entitii Prezentarea entitii1 AFFINE Afine este una dintre cele mai mari companii de afaceri imobiliare din Fran a. n

plus, compania dezvolta i activiti de leasing. Activele sunt localizate n special nParis i n zona nconjurtoare.

2 BIC Bic este unul dintre cei mai importani productori din lume de papetrie, brichete siaparate de ras.

3 CEGEDIM Cegedim este lider european n colectarea, procesarea i distribuirea de date iservicii legate de informaii medicale.

4 CHRISTIAN DIOR Christian Dior este un holding organizat n jurul a mai multor sectoare de activitate:

vnzri de produse de moda si produse din piele, n principal mrcile Louis Vuitton,Cline, Givenchy, Kenzo, Berluti, Pucci, Donna Karan i Fendi; vnzri selective -activitatea desfurat prin Sephora, DFS, Miami Cruiseline i Le Bon March;vnzri de vinuri i buturi alcoolice; vnzri de parfumuri i produse cosmetice;vnzri de ceasuri i bijuterii; proiectarea, fabricarea i vnzarea de articole de lux,precum produsele din piele, pret-a-porter, bijuterii, ochelari, etc.

5 EXEL INDUSTRIES Exel Industries este specializatn proiectarea, fabricarea i vnzarea de echipamentepentru pulverizare agricole, industriale (transport, industria metalurgic i industrialemnului i mase plastice) i piee generale publice.

6 FONCIERE DE REGION Foncire de region este specializat deinerea i administrarea proprietilorimobiliare (birouri, companii, i a locuinelor).

7 PUBLICIS Publicis Groupe este al patrulea grup ca mrime din lume n domeniul comunicriicare realizeaz urmtoarele activiti: servicii de marketing i de comunicareinstituionale i financiare, comunicare de asisten medical, de marketing, etc;

realizarea de campanii publicitare care opereaz prin intermediul a trei reele nntreaga lume (Publicis Worldwide, Saatchi & Saatchi, Leo Burnett i ntreaga lume),etc.

8 REXEL Rexel este liderul mondial n distribuirea de echipamente electrice profesionale.Prezent n 34 de ri, Grupul ofer produse i soluii electrice profesionitilor ndomeniul cldirilor i zonelor rezideniale, n domeniul industrial i alinfrastructurilor teriare, printr-o reea multi-brand, cu 2269 de puncte de vnzare.

9 TECHNIP Technip este un lider mondial n inginerie i construirea de proiecte n sectorulpetrolier i petrochimic.

10 VINCI Vinci este lider mondial n construcii, concesiuni si servicii conexe.11 VIVENDI Vivendi este unul din liderii mondiali n mass-media i telecomunicaii.

Annex 1Presentation of the entities under study

No. Entity name Presentation of economic entity1 AFFINE Affine is one of the France's largest business real estate companies. Moreover, the

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

15/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

194

company develops a leasing activity. Assets are located notably in Paris and thesurrounding area.

2 BIC Bic is one the world leading manufacturers of stationery, lighters and razors.3 CEGEDIM Cegedim is a European leading in collecting, processing, and distributing data and

services related to medical information.4 CHRISTIAN DIOR Christian Dior is a holding company organized around seven sectors of activity:

sales of fashion products and leather goods, mainly the brands Louis Vuitton,Cline, Givenchy, Kenzo, Berluti, Pucci, Donna Karan and Fendi; selective

selling - activity conducted through Sephora, DFS, Miami Cruiseline and Le BonMarch; sales of wines and spirits; sales of fragrances and cosmetic products;sales of watches and jewellery; design, manufacturing and sale of luxury articlesas leather goods, ready-to-wear, jewellery, glasses, etc.; and other.

5 EXEL INDUSTRIES Exel Industries specializes in the design, manufacture and sale of sprayingequipment for the agricultural, industrial (transport, metallurgy and the wood andplastics industries) and general public markets.

6 FONCIERE DE REGION Foncire de region specializes in owning and managing real estate properties(offices, businesses, and residences).

7 PUBLICIS Publicis Groupe is the world's 4th largest communication group. Net sales breakdown by activity as follows: marketing services as institutional and financialcommunication, healthcare communication, reference marketing, etc.; executionof publicity campaigns as operates through three world networks (PublicisWorldwide, Saatchi & Saatchi, and Leo Burnett Worldwide); consulting and

media purchasing services as activities conducted primarily through the networksStarcom MediaVest Group and ZenithOptimedia. The group also develops anactivity of sales of advertising space.

8 REXEL Rexel is the world's leading professional distributor of electrical equipment.Present in 34 countries, the Group offers electrical products and solutions toprofessionals for buildings and for residential, industrial, and tertiaryinfrastructures, through a multi-brand network with 2,269 points of sale. Theproducts and solutions marketed by the group are in response to demands forelectrical equipment, lighting, security, climate control, communication, industrialautomation, and energy savings.

9 TECHNIP Technip is a world leader in the engineering and constructing of turnkey projectsin the oil and petrochemical sectors

10 VINCI Vinci is the world leader in construction, concessions and related services.11 VIVENDI Vivendi is one of the world's leading media and telecommunication groups as

telecommunications and media.

Annex 2Share of inventories value in current assets, respectively in total assets

Share of inventories inEntity name Inventory value Current assetsvalue

Total assetsvalue Current

assetsTotal assets

AFFINE 20.520.000 206.683.000 1.282.304.000 9,92% 1,60%BIC 300.973 1.208.529 2.029,122 24,90% 14,83%CEGEDIM 483 111.568 1.026.055 0,43% 0,047%CHRISTIAN DIOR 5.802 11.311 36.053 51,29% 19,09%EXEL INDUSTRIES 94.790 236.916 326.759 40% 29%FONCIERE DE REGION 117.307 665.008 13.952.606 17,63% 0,84%PUBLICIS 290.000 7.293.000 12.730.000 3,97% 2,27%REXEL 1.141.400 3.816.900 9.054.900 29,90% 12,60%TECHNIP 215,4 4660,2 8570 4,62% 2,51%VINCI 755.700 18.474.800 52.436.100 4,09% 1,44%VIVENDI 777 12 342 58 125 6,3% 13,36%

Annex 3Presentation of information regarding the inventories measurement methods and calculation formulas of inventories

cost at the economic entities under studyEntity name Methods

AFFINE Does not specifyBIC Inventories are stated at the lower of cost and net realizable value. Cost comprises direct

material and, where applicable, direct labors costs and those overheads that have beenincurred in bringing the inventories to their present location and condition. Cost is

calculated using the weighted average method.CEGEDIM Inventories of goods are valued using the weighted average cost method. The gross value

-

8/12/2019 Evaluarea Stocurilor19 IULIA JIANU

16/16

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

Analele Universit ii Constantin Brncui din Trgu Jiu, Seria Economie, Nr. 4/2010

195

of goods and supplies includes the purchase price and ancillary expenses.CHRISTIAN DIOR Wine produced by the Group, especially champagne, is measured at the applicable

harvest market value, as if the harvested grapes had been purchased from third parties.Until the date of the harvest, the value of grapes is calculated pro rata temporis on thebasis of the estimated yield and market value.Inventories are valued using the weighted average cost or FIFO methods.

EXEL INDUSTRIES Inventories are valued at the lower of cost price and or net realizable value.It is used FIFO.

FONCIERE DE REGION They are recorded at acquisition price and, as applicable, are subject to depreciation inrelation to the realizable value (independent appraisal value).

PUBLICIS They are recognized on the basis of costs incurred and a provision is recorded when theirnet realizable value is lower than cost;

REXEL Inventories are stated at the lower of cost and net realizable value. Cost is calculated byreference to a first-in first-out basis, including freight in costs, net of any purchaserebates.

TECHNIP Inventories are recognized at the lower of cost or market value with cost beingprincipally determined on a weighted-average cost basis.

VINCI Inventories and work in progress are recognized at their cost of acquisition or productionby the entity. At each balance sheet date, they are measured at the lower of cost and netrealizable value

VIVENDI Inventories are valued at lower of cost or net realizable value. The amount includes costof purchase, costs of production and other supply costs and packaging. It is generally

calculated on a weighted average cost. Net realizable value is the estimated selling pricein the ordinary course of business less the estimated costs of completion and estimatedcosts necessary to make the sale.

Annex 4The amount of adjustments for inventory impairments and descriptive information regarding the impairments of the

inventories presented by the economic entities under study in the notes to financial statementsEntity name Impairments for depreciation

AFFINE 1.843BIC 24.643CEGEDIM Impairment is recorded if the book value is less than the inventory value (net realizable

value).CHRISTIAN DIOR Provisions for impairment of inventories are chiefly recognized for businesses other than

Wines and Spirits. They are generally required because of product obsolescence (date ofexpiry, end of season or collection, etc.) or lack of sales prospects.

EXEL INDUSTRIES Does not specifyFONCIERE DE REGION Does not specifyPUBLICIS A provision is recorded when their net realizable value is lower than costREXEL Does not specifyTECHNIP Provisions for depreciation are recorded when inventories net realizable value is lower

than their net book value.VINCI Does not specifyVIVENDI Does not specify

Annex 5Information on the how NRV is calculated, presented by the economic entities under study in the notes to financial

statementsEntity name Presentation of information on how nrv is calculated

AFFINE Does not specify

BIC Net realizable value represents the estimated selling price less all estimated costs ofcompletion and cost to be incurred in marketing, selling and distribution.CEGEDIM Does not specifyCHRISTIAN DIOR Does not specifyEXEL INDUSTRIES NRV is the estimated selling price of normal business, less selling expensesFONCIERE DE REGION Does not specifyPUBLICIS In order to assess net realizable value, inventory and costs billable to clients are reviewed

on a case-by-case basis and written down, if appropriate, on the basis of criteria such asthe existence of client disputes and claims.

REXEL Net realizable value is the estimated selling price at balance sheet date, less the estimatedselling expenses, taking into account technical or marketing obsolescence and risksrelated to slow moving inventory.

TECHNIP Does not specifyVINCI Does not specify

VIVENDI Does not specify